The Millennial Shift is Underway

What are your assessments on the current economy?

There are many changes underway whether it is realized or not.

It is almost like we are seeing several repeats in history all at once.

Today, we will address some insights on possible shifts in the economy, it’s effects and how you can better prepare for what is in store.

We will cover several topics, from real estate, to stocks, to economics.

So what is going on? Well, there are many topics we can start from.

But, let’s start with the last real estate bubble.

Leading Into The Last Real Estate Bubble

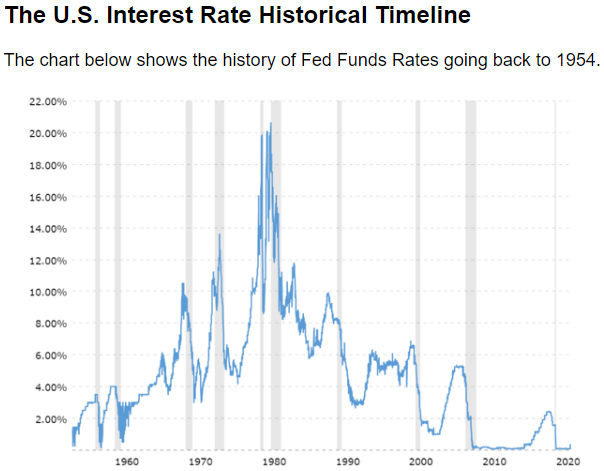

In the early 1970’s, there was a recession during the presidency of Richard Nixon. The causes were the 1973 oil crisis, the emergence of newly industrialized countries, triggering the steel crisis, and then the stock market crash in 1973-1974.

Unemployment peaked to nearly 11% in the early 80’s and mortgage interest rates rose to 16%.Interest rates declined, but did not drop below 8% until the mid 1990’s.

When mortgage rates are this high, people get creative when borrowing money. This creativity includes higher use of loan products that will help best in the short term and then transitioning into a new long term loan product. Adjustable rate and interest only mortgages usually gain popularity during times like this.

Higher use of adjustable rate and interest only mortgages was consistent until the housing boom of the early 2000’s when interest rates dropped below 6%.

Let’s not forget about the roaring commerce that the “.com” era brought in the early 1990’s as well. This was the stimulation that fueled the emergence of several emerging markets.

Needless to say, we probably got a little to laxed in using various loan products too liberally.

Therefore, when too many loans, including predatory lending, were issued and people began defaulting in the 2007-2009 era, we did not expect this outcome.

Quickly the predatory lending was acknowledged followed by thousands of foreclosures. These foreclosures brought housing values back down as quickly as they had risen.

Although many speak about a bubble today, the circumstances are much different.

- See our article on Solutions For Home Buyers in Today’s Market for insight if you’re shopping for a home.

While some of these factors are present today, we had several saving graces to help prevent the same events from happening due to COVID-19. A few were stimulus payments, mortgage loan forbearance, student loan forbearance, rent moratoriums and rent relief packages for tenants.

- We also have had a housing inventory issue that’s been present since 2014/2015. See our article titled Real Estate Trends: Data & Economic Impacts for insight on how the housing inventory occurred.

The emergence of Airbnb as well as the high property sales, was a double duo at reducing housing supply that no one took heed of. Today, millennials and GenZ buyers are not being accommodated because supply has caused several buying pools to merge and compete for the same houses.

With the abundance of available jobs, pent-up demand to travel, shop and get back to normal pre-COVID conditions, our conditions today are not as they were during the recession of the mid 1970’s. However the demand for industrial real estate, housing development, and inflation are upon us.

The isolated uniqueness of today’s circumstance, is that we have a high demand to fill labor roles vs not having enough enough jobs.

If we can answer the demand for better pay and get everyone back to work, we can fill these labor gaps and supply chain concerns. If accomplished, we could see a very strong economy return rapidly.

Stock Market Sentiment, Inflation & Bitcoin

During times when recession is possible or near, people extract their liquid assets that are most accessible. We almost had a hero in Bitcoin, to hedge the growing concern of recession, but it’s inconsistency changed the market sentiment quickly.

Bitcoin rapidly grew to $60,000 in 2021 after being under $1,000 in 2016. Many rushed to join the momentum, investing whatever they could, to hopefully profit quickly from the achieved growth. Expectations were that Bitcoin would grow to $100,000 by early 2022.

Although, it could have been a saving grace, it did not happen. Bitcoin dropped to $36,000 and has been channeling between $36,000 and $61,000. Most currently channeling between $42,000 and $48,000.

Needless to say, people began cashing out of stock positions to relieve themselves of the possibility of excessive loss. The S&P 500 dropped 10% in a matter of 3 months from 2021 year end to March 2022.

While cryptocurrency is still a thriving industry and will continue to grow, it’s market sentiment is inconsistent and will be tested for it’s true potential over time.

As inflation continues to grow, people will have less and less cash or disposable income.

The only caveat to this equation, is the extraction of people needing money for down payments for houses, with no houses being available, the pent-up pressure in buyer demand will not be relieved. Therefore, this cash will be somewhat available for other usage.

While consumers wait for houses to be available, I doubt the bank will be the holding facility that they will opt to use in the meantime.

There is a possibility that the stock market will see reinvesting occur, due to this factor.

During this time, strong and conservative companies would be ideal.

Economic Growth & Energy

Amongst the thriving industrial industry fueled by ecommerce, and the home building industry, we have the transition to new energy upon us. The energy industry will encompass cars and infostructure throughout the world.

Demand has been compared to post World War II days, where the industrial industry saw it’s most abundant emergence. The face of real estate is changing and this demand is back.

Precious metals will continue to show demand for all of these developmental needs.

- See our article diving deeper into these factors titled The Era of Change & Investing.

Copper, lithium and steel are just a few of the metals that will be in high demand in the foreseeable future.

Commodities would be a ideal investment during these times.

Conclusion

From recessionary symptoms, to emergence of new markets, we are in an era of massive change. There will continue to be consistent adoptions of innovations as well as new norms.

If you are not paying attention and getting involved within many possible lucrative market’s growth, you can miss a historic time that is and has been underway.

The next 10-20 years, will be very interesting.

Thank you for joining us today faithful readers – future leaders.

Love ya and continue to strive for growth.

Please comment your thoughts or additions to this conversation.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.