Home Buying Solutions for Home Buyers in Today’s Market

Today’s market is very challenging for home buyers.

So, what are you doing to minimize the competition and do your best at securing some equity?

There are some eligible options out there that can increase your chances.

Join us today for some helpful pointers.

It is common that some buyers are discouraged, tired and possibly fed up with all the overbidding.

Common thoughts, are:

- How can I be sure the market won’t turn upside down?

- Am I buying at a time that makes sense or should I wait?

- Is there a “housing crash” coming or not?

There is a lot of media out there and it can be overwhelming.

Today, we will use some logic behind our opinions. So far, there has been a lot of clickbait out here.

Six months ago, everyone was saying housing crash, housing crash, housing crash…Now, within the last three months, its been, “No housing crash in sight…”

So let’s get to the root of the concerns.

Is a Bubble Possible?

Let’s take 2008 into consideration and pull the facts out of what caused that bubble to burst.

Predatory lending with subprime mortgages, and very low credit scores being accepted amongst borrowers, were the primary causes.

In the late 90’s, lenders had given loans to borrowers with very low credit scores in a crusade to help make homes more accessible to borrowers.

Many borrowers had bought above their means and when those adjustable rate mortgages (for example) encountered increased mortgage notes, many borrowers fell into foreclosure.

The pleather of borrowers who had been placed in homes, now facing hardships, caused many lenders to face hardships as well.

In turn, this caused the rapid decline of real estate values as lending practices were corrected and bailouts ensued.

Today, this is not the same scenario.

- We have had stringent underwriting from lenders, for several years, with an increase in the eligible credit score requirements for new homeowners.

- We also had a halt in the development of new housing when the bubble burst between 2008 and 2012 affecting supply issues.

That’s not all. The underlying issues causing today’s rapid increase in home values includes several more factors.

- AirBnB began to really gain market share right when the bubble burst, and began growing at a rapid pace ever since. Therefore, holding of assets that would have been sold in a previous market, began.

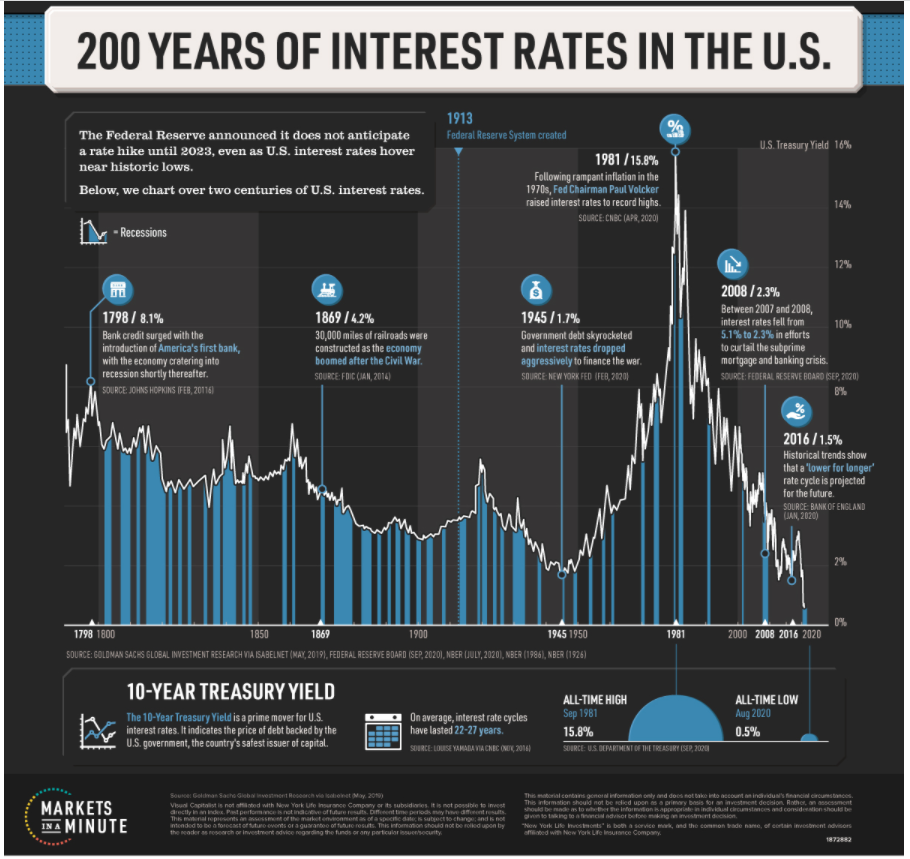

- Also interest rates dropped in 2014, took a slight increase from 2016 to 2017, and then continuously dropped up to today.

All of these scenarios caused more buying, more holding, and still, no development occurring.

By 2018, the housing market’s supply, was rapidly thinning and the seller’s market began because of an inventory.

Now, we’ve had simultaneous buyers and sellers market since 2018.

Then, COVID hit and interest rates dropped again. This directly caused more depletion of inventory as buyers bought faster, and property values rapidly inclined.

With moratoriums and forbearances being allowed, many borrowers and renters have been allowed a grace period of recovery time. In 2008, there were no graces periods granted.

Being that these grace periods were granted to borrowers and renters, there should not be an issue unless borrowers were facing foreclosure prior to COVID. Thus far, this data has not been communicated.

Therefore, I don’t see a decline in home prices coming this year.

When mortgage rates increase, we will have some buyers that will be less capable to pay higher prices for homes. Of course, this stated sentiment will highly depend on how much the interest rates increase.

However, with supplies being as low as they are, competitive buying will not go away.

Therefore, the prices could decrease slightly, flatline or increase. The likelihood of flatlining or increasing, is more probable due to the supply.

Buyers are already deciding to wait everything out and just rent until they can make a decision. Renting will continue to increase. If supply was higher, then a decline in prices would make more sense.

Inventory is still about 60% under plan with a forecast of 6 year minimum for builders to catch-up (and that includes if they double their current rate of building).

With questionable interest rate hikes, builders are approaching new building very cautiously as well. Therefore, supporting the supply issue continuing.

It is very likely that housing supply will not be caught up for 10 years.

Ultimately, it is still a great time to buy. Lowest rates you’ll see for decades and low supply.

How Homebuyers Can Beat the Competition

Here are two recommended strategies for those looking to purchase, but want less competition.

Purchase New Builds –

It is common that homeowners that purchase new construction see 10-20% gains in appreciation within the first few years. Check here for finding your local builders to achieve getting your new home.

Couple this strategy with acquiring down payment assistance and you’ve really hit a homerun.

- Check this source that is awesome at outlining the steps in acquiring down payment assistance if you need a guide.

- We also recommend using this Home Buying Investment Calculator. It combines all financial aspects of the home buying process. This investment calculator for home buying combines the debt to income analysis, the affordability analysis, the mortgage calculator, an exit strategy and the transactional and closing cost incorporated with the purchase! Great tool!

As a homeowner, you will be a top bidder for any home that is being sold AS IS and requires renovation.

This is a fact, because you will not be accumulating higher borrowing costs, back-end closing costs and allocating a profit margin, as an investor would.

If you use a 203k or a HomeStyle Renovation loan, you could achieve landing your new home and renovating to you’re liking. Couple this strategy with acquiring down payment assistance and you’ve hit a homerun again.

The only investor you’d likely compete (if any) with would be the short term rental (or Airbnb) investor. Depending on cost and location, a STR investor could possibly pay market value.

– Check this source that is awesome at outlining the steps in acquiring down payment assistance if you need a guide.

Conclusion

Buying today is better than buying tomorrow.

Waiting does not show an advantage to any buyer due to interest rates increasing by 2023, and home prices continuing to climb due to the overwhelming supply issue.

If foreclosures are abundant and hit heavy in 2024-2026, those homes will also be purchased, renovated and resold at market values.

Also, supply will still be low, even considering foreclosures hitting the market.

Thank you for joining us today faithful readers-future leaders.

We hope today’s article has been helpful and we look forward to your progress.

Please comment your experience or opinion on what the upcoming housing market will look like.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.