How to Use Data to Track Economic Trends and Impacts in Real Estate

With so many changes occurring how are you using data to impact your investing decisions?

COVID-19 has catapulted our progress and changes are happening rapidly.

Let’s discuss the impacts of today’s trends, current market sentiment, and forward planning.

As we all know COVID-19 has caused rapid change in our “inevitable” future, quite quickly.

Many say the changes experienced were going to happen.

It was just a matter of time.

However, what would have taken years to occur, happened in a matter of months!

Market Sentiment

There are quite a bit of variables on our table, and today, we are going to take a minute to discuss each.

Economic impacts and economy news directly affects real estate.

Let’s begin…

Housing –

As we can all attest to, its like the writing was on the wall. But, we didn’t take notice to it, or changes occurred so fast that we couldn’t catch up.

Let me explain. It seems like yesterday, even though it was the early 2000’s, where condos were going up everywhere and everyone felt like it was time to slow the pace of new development.

Then, we had the bubble burst in 2008/2009 where housing took a fall.

At the time where we slowed development, it appeared as the correct thing to do.

In hindsight, it was not. As we all know the housing shortage is causing much despair on the buying side of things.

- Also, around the same time when the housing “bubble” burst, we had the launching of AirBnB in October of 2007 as AirBednBreakfast.com.

- AirBnB has seen excellent success having a net-worth of $2.4M in March of 2009, to being worth $83.4B today!

This has a direct relation to available housing today and our inventory being over 50% less than last year. See article here at Realtor.com June 2021 Monthly Housing Market Trends Report.

Super, that we are creating more wealth and investors, but an unforeseen potential hardship was underway related to the supply of houses on the market for buyers.

The slowing of development and the rise of short term rentals, play a significant role to the housing shortage.

Interest Rates –

The effects of housing to interest rates, have also been directly affected by the economy.

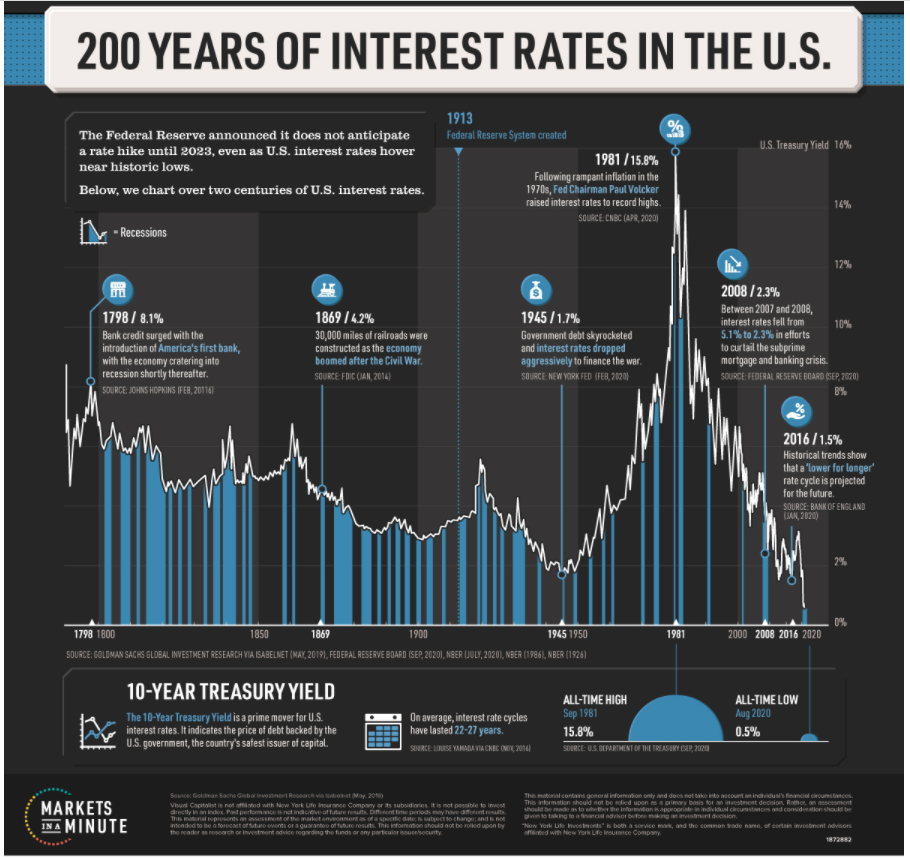

We went from a high of a approximately 7% interest rate in 2000, to a temporary record low of a 1.5% interest rate in 2016. This low interest rate in 2016, was a catalyst to creating more home buyers.

See the 200 year history of interest rates courtesy of https://advisor.visualcapitalist.com/us-interest-rates/.

Very interesting to see the graph illustrating the movement of interest rates over the last 200 years…

We’ve seen frequent buying of homes as rates continued to decline after 2016, bringing the housing market into more popular demand.

Currently, the fed is not anticipating any rate hikes any time soon. Feedback is saying feds are not anticipating any rate hikes until 2023…See article from CNBC here.

Therefore, we can expect that the housing market will not “cool off” anytime soon.

Buyers need to keep this in mind as they contemplate their best future investments.

COVID 19 –

There are so many effects that COVID-19 has had on the economy.

It will be difficult to pinpoint as many topics as I’d like to without this article getting too extensive, but here are a few key points.

What we do know is, COVID-19 catapulted the growth we would have achieved over several years, in a matter of months.

This includes, ecommerce, the demand for real estate supported by low interest rates, and the reaction of people wanting more secure settings to allow remote employment, freedom, comfort, and the ability to enjoy life safely.

- Expansion to suburban and more rural areas has been a result of COVID-19 where people have departed super dense cities to try to keep their families safe.

- Travel has changed to where more people began appreciating amenities within driving distance. This promoted higher demand for Airbnb and vacation homes particularly at waterfronts.

- Housing amenities have trended toward buyers wanting more space for offices, fitness and yard space. Many are upgrading garages to accommodate a portion of this demand. The layout of homes has changed and will do so going forward.

- Working from home has been highly desired and has caused a change in demand for commercial office space. Companies are currently responding to this demand as they gauge what will be supported and what won’t be. Many employees have left their jobs if their remote working lifestyle could not be supported. Stats say 1 in 4 workers are considering leaving…See article from CNBC here.

- Unemployment pay and stimulus payments started post COVID-19 and has caused a lack of desire by employees to return to the workplace. Since many employees are earning more being off from work, they are opting to temporarily not work. Although reopening of the country has occurred, most employers are finding it very difficult to staff accordingly.

- Small businesses have seen extreme difficulty to find talent as applicants are low. Hiring bonuses and pay scale changes have become the norm for several employers as they try to entice more people to apply.

- The lack of ability to support many employers’ labor needs, has caused a huge strain on keeping up with demand. Materials in most industries, including housing are short on stock. Therefore, material prices have inflated so that companies support their bottom line. As labor suffers, the end-result is inflation of on the shelf prices. Inflation of prices seemed to begin in June.

- Lack of supply has caused inflation to show signs in several industries immediately after the country re-opening which increased the consumer presence. This effect has trickled its way back to housing, causing an increase in the cost of homes. This has created more pain for buyers. See survey results, curtesy of NAHBnow.com here, where results show costs of materials for homes reflect an average increase of 26.1% where the previous record was 6.1% in 2017.

- Development for the builders of housing is so overwhelmed, due to the demand, that builders are booked solid and some are turning work down. We can expect that developers will see high demands for years to come and likely for the next decade. However with material costs still high, the cost of homes will not decline. Projections on supply catching up to demand is estimated to be about a year. Be aware that the production from quarters 2-4 of 2020, and the first quarter of 2021 are all backlogged.

Cryptocurrency –

With the craze of bitcoin and cryptocurrency, the demand for decentralized funding is upon us.

Many are adapting and many are resistant to this change as the need to create secure measures in the trading of cryptocurrency is still a concern.

However, cryptocurrency has already been accepted as forms of payment for buying homes and by some landlords from their tenants as rent payment. See article here by Updater.com.

Could cryptocurrency be the hedge that can help us avoid higher levels of inflation?

Many are asking this question, attempting to be proactive and solution oriented. However, the volatility of the cryptocurrency market is concerning for many.

Bitcoin was once over $60,000 just months ago, and bitcoin is now under $30,000. This is a concern for any brokerage if they were accountable for such price fluctuation.

Although a promising way to build wealth, there is sentiment from governments to have better control over this form of currency.

It will be interesting to see how directives for cryptocurrency investing will be issued to the public in the future.

We are seeing more and more Fortune 500 companies adapt to either allowing or investing into cryptocurrency themselves.

This article shows that 54% of the top 100 Fortune 500 are investing in blockchain technology.

We shall see how this goes in due time.

It is evident that cryptocurrency has arrived and is not going anywhere.

Emerging Markets –

As the markets manage accordingly to current business cycles, it is apparent that many changes are underway.

From the expansion of buyers to the suburbs, to the change of what norms will become, many markets will change in respect to growth or decline.

With the emergence of ecommerce comes the demand of industrial real estate.

Of current, this is in very high demand due to the ecommerce demand. COVID-19 has caused exponential growth in ecommerce. As this demand matures, several markets will emerge.

Combine the nature of retail and the norms of COVID in relation to housing, and you have new practices that will become norms as time passes.

Population growth, unemployment rates, and median household income will be key characteristics to monitor as cities either expand or contract.

Big box employers like Amazon, Apple, Microsoft, Facebook and Google are continuing to open new fulfillment locations and are key contributors in these changes.

Any investor would be wise to keep a close monitor of these attributes as key investment opportunities. Markets like Phoenix, Salt Lake City and Austin, Texas are in high demand currently due to many of these characteristics.

However, not all growth has to be in a major metropolitan area for an investor to capitalize.

As labor markets increase, the demand for the consumer price index (CPI) to get back in alignment with home prices is upon us.

Rent increases are at record rates to catch up to the demand in housing.

The changes in housing prices and rent increases, will create a demand by buyers for more space.

This is where renters and buyers will look for more for less money. This translates into moving further from metropolitan areas, in attempts to find a bargain, to avoid the demand.

Expect outlining areas within a radius from metropolitan areas to see an increase in demand. Keep your eyes open for these tendencies and invest accordingly.

Thank you faithful readers-future leaders for joining us today.

Love ya and keep striving for growth!

Please comment your opinion on today’s market and the effects to our current market.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.