Maximize Your Rental Property Profits – Discover the Ultimate Investment Calculator!

Unlock Success – Meet Your New Rental Investment Calculator

Are you tired of relying on guesswork to evaluate rental properties?

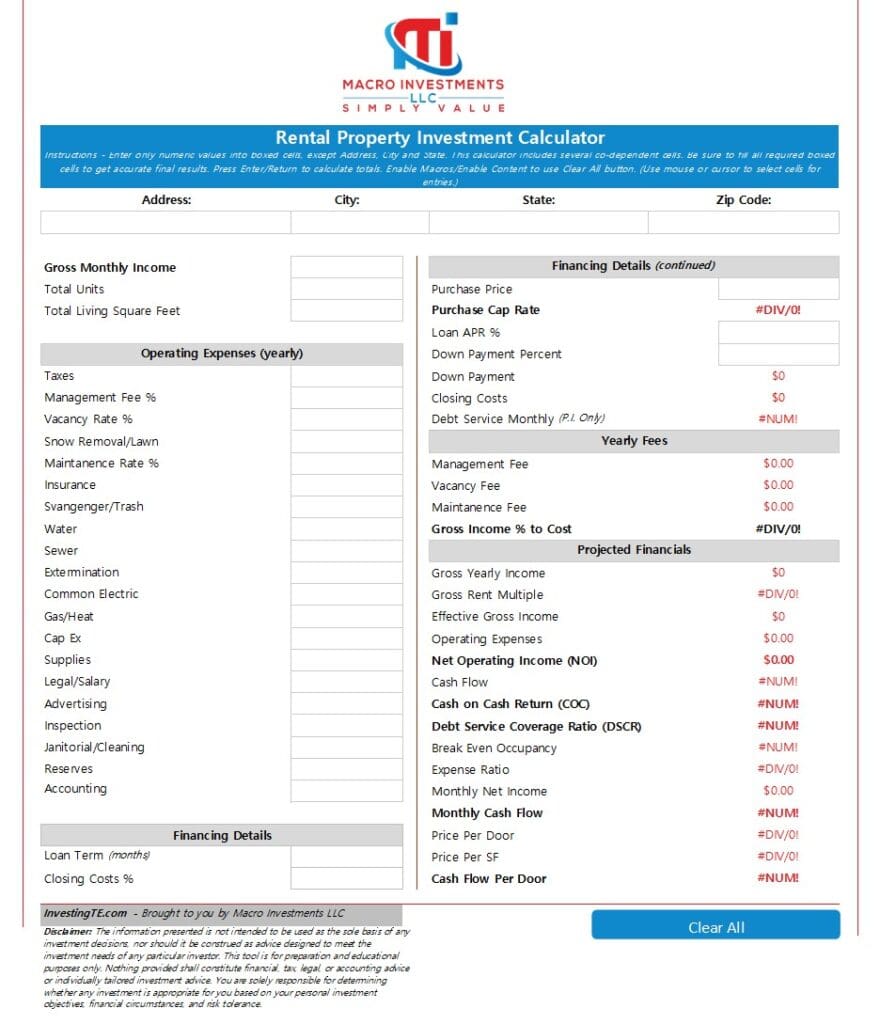

Say hello to our Rental Property Investment Calculator – the ultimate tool for savvy investors.

Learn how this powerful calculator can help you make smarter decisions and maximize your profits.

The Power of Numbers – Why You Need a Rental Property Calculator

Numbers don’t lie – they’re the key to unlocking profitable real estate deals.

But unless you’re a mathematical genius, you need a reliable tool to crunch the numbers for you.

Our Rental Property Investment Calculator does just that, helping you evaluate deals with precision and confidence.

Understanding Your Investment – How the Calculator Works

Discover how our Rental Property Investment Calculator works and why it’s an essential tool for real estate investors.

Whether you’re evaluating residential or commercial properties, this calculator provides detailed insights into potential income, asset class, operating expenses, and more.

Plus, with our comprehensive financial analysis, you’ll have everything you need to make informed decisions and maximize your returns.

Within either evaluation, asset class is a integral portion of the evaluation as well. Asset class relates to CAP rate, and CAP rate equates to property valuation trends.

- To get a comprehensive look at evaluation techniques, see our articles 5 Ways to Evaluate Rental Property and Understanding CAP Rates.

Actual income, potential income, asset class, and CAP rate trends can help you understand the income potential of the asset.

However, operating expenses, loan choice and entrance/exit strategy play a significant role as well.

Maximize Your Profits – Features of Our Rental Investment Calculator

Explore the advanced features of our Rental Property Investment Calculator and see how it can transform your investment strategy.

From targeting specific cash flow goals to analyzing capital expenses and budgeting effectively, this tool provides a complete solution for real estate investors.

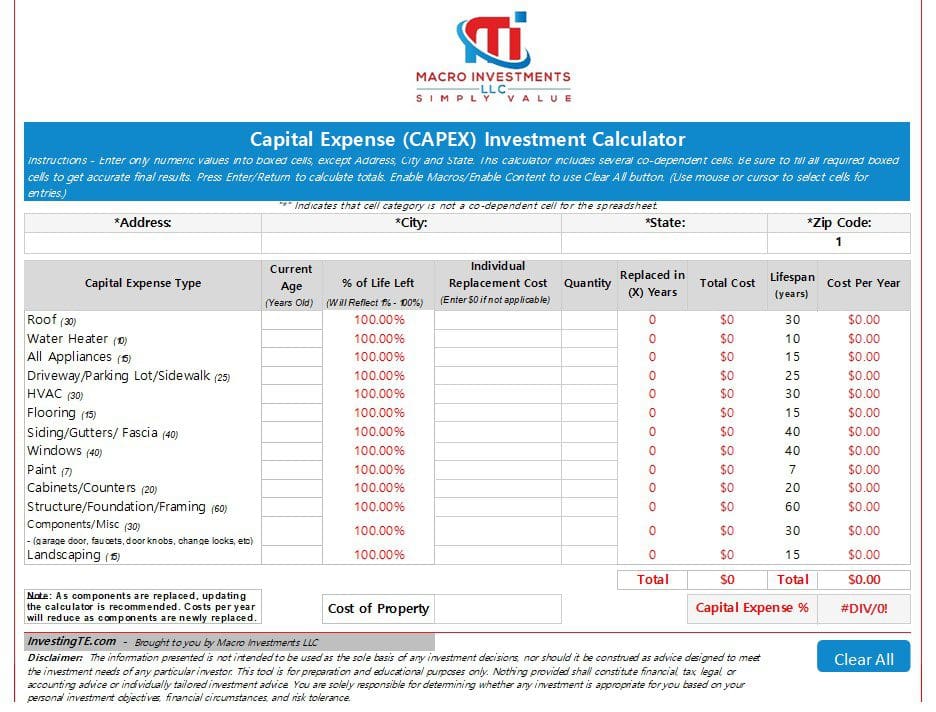

Plus, with our package discount, you can save even more when you purchase our Capital Expense Investment Calculator alongside it.

- Save when you shop both in our Rental Property Package 1 receiving a 10% discount on both the Rental Property Investment Calculator and the Capital Expense Investment Calculator.

We all know every property’s capital expense plan is never the same.

Budgeting accordingly, could be the difference in you consistently increasing your portfolio or you slowing the growth in your investment career.

Invest in Your Success: Get Your Rental Investment Calculator Today!

Ready to take your real estate investments to the next level?

Purchase our Rental Property Investment Calculator today and unlock the key to success.

With its user-friendly interface and powerful features, this tool will become an invaluable asset in your investing toolkit.

Don’t miss out – get yours now and start maximizing your profits!

Take Your Real Estate Career to New Heights with Our Rental Investment Calculator

Stop leaving your success to chance and start making data-driven decisions with our Rental Property Investment Calculator.

Whether you’re a seasoned investor or just starting out, this tool will help you achieve your financial goals faster and more efficiently.

Invest in your success today and watch your real estate portfolio thrive.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.