Learn 5 Ways to Evaluate Rental Property Investments

What is the key criteria in evaluating rental property investments?

There are many various investment strategies in real estate.

However, owning rental property is very common to most investors involved in real estate.

Real estate assets are also closely tied to economics.

The economics of a location, has a lot to do with how the investment may perform over the long-term.

Today we will go over several components of how a rental property can be evaluated.

Let’s get started.

Although “location” is always spoke of, the components that make up the detail within “location,” may not be well explained as much.

So, lets start with everything that relates to location.

1) Cap Rate

Capitalization rate or most often referred to as cap rate, is usually relative to location.

Understand that a cap rate will only show a trend if there is enough sales history to validate a trend. In some locations, this is not reliable because there isn’t enough depth in the sales history for like-kind properties. In others locations, there is a much depth of historic sales where a reliable cap rate can be referenced.

When there is depth to historic sales, the potential of location can be easily observed.

Many times, in large metropolitan areas, the cap rate can be isolated to the exact neighborhood or township.

A cap rate can tell you a lot. But, most effectively it tells you the rate at which you can expect your capital to grow.

- Note: It is important that you understand the difference between using commercial evaluation methods versus residential evaluation methods based upon the property make-up. Four units or less is residential. Five units or more, mixed-use, and everything else, is commercial.

The reason cap rate is such a popular method of evaluating an asset is because it quickly allows you to arrive at a property value.

Take the value formula for example.

VALUE FORMULA

- Value = Net Operating Income/Cap Rate

The value formula of is a very common equation used in evaluating rental property. If you have the cap rate, all you need is the income and your expected operating expense ratio.

- See more formulas like this, used in evaluating real estate, here in the article Real Estate Formulas 101.

- Also purchase or get a free rental property calculator here.

From this simple value formula, while knowing the income and your operating expense ratio, a value can be computed rather quickly.

For more tools to assist you in evaluating rental property, see quality Microsoft Excel-based real estate investment calculators here.

- Rental Property Investment Calculator

- BRRRR Investment Calculator

- CapEx Investment Calculator

- Multi-Family Buy & Hold Value-Add Investment Calculator

This leads us to our next topic that will provide more visibility into how to evaluate a location.

2) Asset Class

Asset class is a key aspect that you should always know.

Not only does asset class tell a story, but it helps you to know the potential of the asset.

Asset class closely relates to cap rate being that cap rate ties to the rate of growth expected.

A rate of growth, directly relates to economics.

A high potential growth rates show locations with more economic strength and low potential growth rates show locations that are more so challenged with achieving economic strength.

The cap rate will show variance by geographic location. However; the lower the cap rate, the higher the potential for the asset to appreciate, indicating more economic strength. The higher the cap rate, the lower the potential for the asset to appreciate, indicating more economic challenges for the location.

This is where asset class comes into play by helping you identify economic strength or economic weakness (or challenges).

Asset classes are classified as A-class, B-class, C-class and D-class.

A-class being the highest potential for appreciation, and lowest cap rates, and D class being the lowest potential for appreciation, and the highest cap rates.

Therefore, it is relative to use cap rate values in helping identify asset class.

General Asset Class References:

- A Class brings cap rates of 3% to 5%.

- B Class brings cap rates of 6% to 8%.

- C Class brings cap rates of 9% to 11%.

- D Class brings cap rates of 12% or more.

Once you can identify the cap rate, you can also identify what asset class the location is in.

Once again, in areas where a cap rate trend is not reliable due to low sales volumes, you will need to use other methods to determine the asset class. While, the characteristics that make up the locations’ potential must still be validated, you will need to use other methods of figuring out the asset class of the property.

Note: Sometimes you may find B-class income in an A-class area. This is just an example and would be an indication to potential to achieve higher income and a possible good investment.

- For guidance on how to learn to evaluate rental property please check for Acquiring Rental Property: Learning Your Options for Starting Your Investment Portfolio by C.R. Wesley.

- Get the eBook here or any format (audiobook, paperback or eBook) here.

Next, let’s review a few other factors that help evaluate a location.

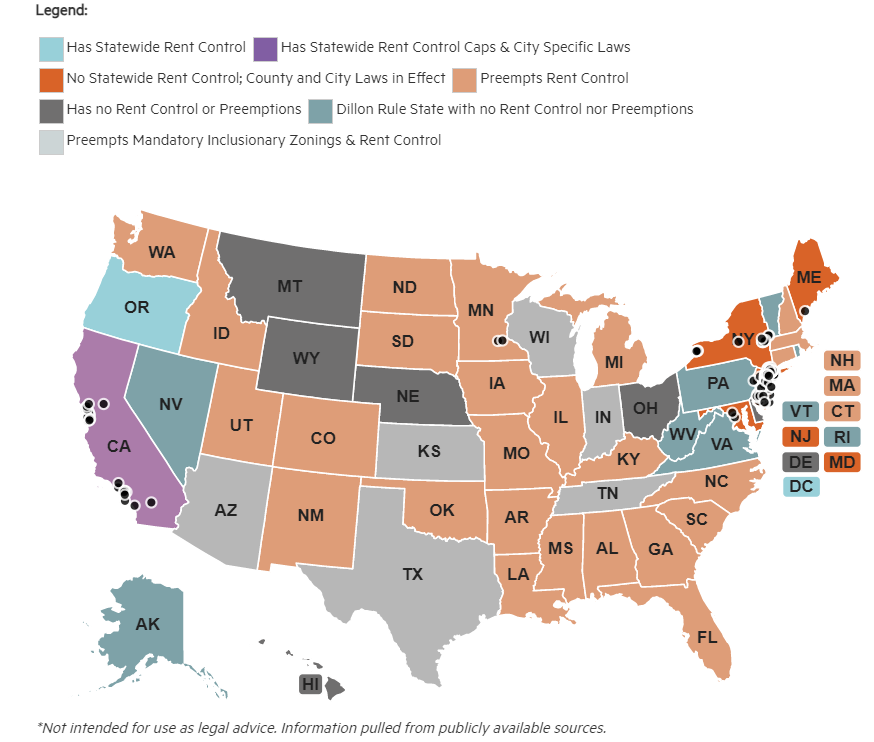

Often we hear about landlord friendly states versus tenant friendly states. But, we don’t know what makes up these characteristics.

The last three topics align to the factors that dictate a location being more landlord friendly versus more tenant friendly.

3) Rent Control

Rent control is a measure of how rents can or cannot be raised based upon the state, county or city regulations.

It is important that you not only review your state-level landlord-tenant laws, but you also know state, county or city regulations on rent control.

Courtesy of the National Multifamily Housing Council, see the chart below on state level detail on rent control.

Also, here is a pdf of the document.

This brings us to the second topic that helps evaluate locations for rental property which is property taxes.

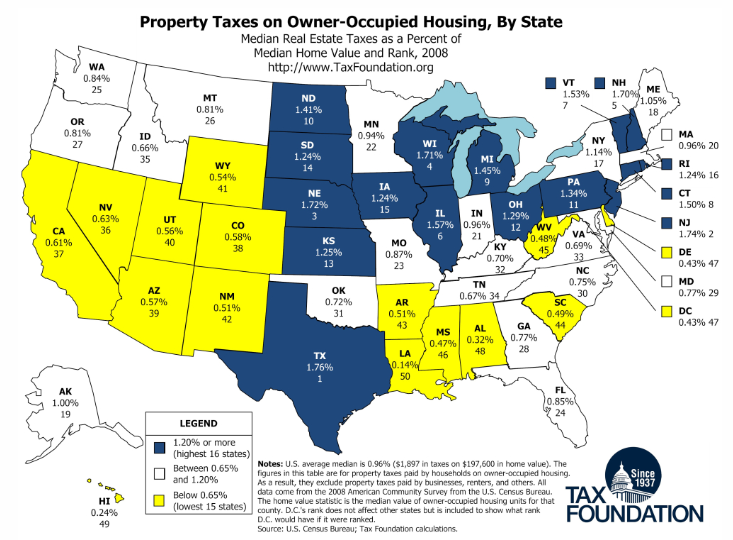

4) Property Taxes

Property taxes, next to your mortgage and insurance costs, is one of the highest operational expenses in managing rental property.

Each investment is different based upon your cash flow analysis, but the cost of taxes is a integral part of where you may and may not choose to invest in real estate.

Afterall, lowering your expenses increases your net operating income or NOI. Objectively, you always want to run your business at an optimal rate and increase your NOI.

Check out the chart below courtesy of TaxFoundation.org showing the property tax rates by state.

Last but not least, the eviction process matters. This brings us to our last topic.

5) Eviction Laws

Although the last desirable resort, evictions are necessary.

The eviction process can be a defining portion of how you are able to manage your business efficiently.

Of course, you’ll need to be a great communicator from the start, and have a great property manager, if not yourself. But, every so often, an eviction may be necessary.

This is where you must be familiar with your local landlord-tenant laws as well as the process of what an eviction looks like.

- See the linked detail regarding evictions by state courtesy of iPropertyManangement.com.

- See the PA eviction process map for other local PA investors on our Real Estate News page.

Conclusion

Evaluation tools are crucial to making good investment decisions.

Although there are plenty more details involved in properly evaluating a location, these are the basics.

- For more detail on evaluating investments, see our articles How to Evaluate Emerging Markets, Understanding Cap Rates and Understanding Location, Location, Location.

Thanks for joining us today faithful readers – future leaders.

Love ya a keep striving for growth.

Please comment how you go about evaluating rental property investments.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.