What to Expect in Our Economy Moving Forward and Investing

Where are people putting their money?

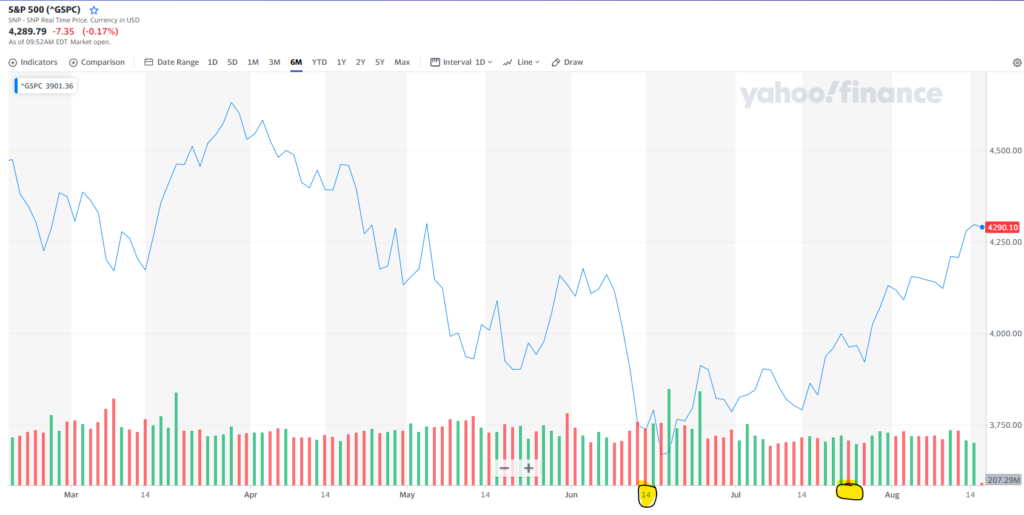

Recently, we’ve noticed a rapid recovery in market lows.

Signaling a swift rebound to market bottoms in the stock market.

As options remain low, you must consider, where are people putting their money…?

Let’s discuss a bit of speculation that could possibly help our fellow investors out there.

Let’s get started.

Sentiment

Consumers are definitely frustrated. The economy is in inflation, pay is not caught up to expenses and there is a lack of real estate…

However, frustration cannot become erratic decisions.

- People should, and seem to be remaining calculated in their decisions.

As previously mentioned in The Millennial Shift on 4/12/22 –

- “As inflation continues to grow, people will have less and less cash or disposable income.

- The only caveat to this equation, is the extraction of people needing money for down payments for houses, with no houses being available, the pent-up pressure in buyer demand will not be relieved. Therefore, this cash will be somewhat available for other usage.

While consumers wait for houses to be available, I doubt the bank will be the holding facility that they will opt to use in the meantime.”

It wouldn’t be surprising that investors are not being hesitant regarding other investment opportunities. Even though housing supply is way down and they can’t spend their money there.

- Have we seen proportional stock market bottoms? Yes, we have.

- We will see more? Yes. Very likely.

However, seeing the rapid rebound, after the CPI report last week, bottoms may be short lived.

Let’s review the market indicators we’re referring to.

Market Bottoms?

The Fed has raised rates throughout the year with the next planned Fed meeting September 20-21.

However the highest rate hikes were the last two. Which were 75 basis points each on June 14-15 and July 26-27.

This is when the stock market dipped the most.

See a 6-month chart of the S&P 500 below.

- Notice the dips when the rate hikes took place.

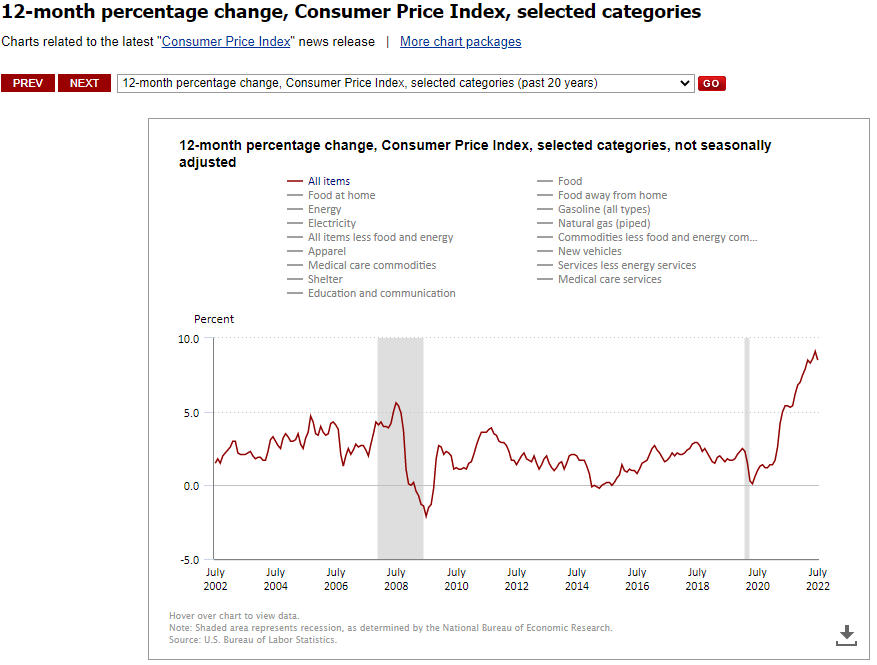

The next component of our economy is inflation. Inflation has been rising for quite some time.

In fact, we haven’t seen a drop in the CPI (consumer price index) for two years until the CPI report on August 10, 2022. The next report is September 13, 2022.

See the chart below illustrating the CPI for the the last 20 years. Notice we saw the first dip since July of 2020.

- Within this short period of time, from August 10th to today, the S&P 500 has went up approximately 2%.

Although, I wouldn’t say we have seen all possible market bottoms, sentiment definitely shows that consumers are engaged and reacting swiftly.

- The pent-up demand is still alive and thriving – and ready for application.

The performance amongst company quarterly earning reports will be the next tell-tale signs of our possible economic trends.

With hiring freezes, layoffs, continued supply chain issues, and struggles with acquiring and obtaining talent, I foresee more underperformances.

The forthcoming earning reports in late September and October will provide visibility into our challenges.

- Hopefully, the CPI reports on September 13th and October 13th will be positive.

Keep an eye out for these indicators so you can take heed to your next best investment play.

Thanks for joining us today faithful readers – future leaders.

Love ya and continue to strive for growth.

Please comment your plans for the upcoming 6 to 12 months.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.