The Best Ways to Avoid Losing Equity While Home Shopping Today

Do you know anyone concerned with losing equity after purchasing a new home today?

This is a common concern in this economy as economic conditional changes are underway.

We have unemployment concerns, supply concerns, inflation concerns, and concerns with the cost of borrowing.

All of these conditions combine to create the possibility of change in housing values across the nation.

So how do you prepare for your potential purchase and avoid the concerns that weigh heavy today?

Today we will review a few indicators and our thoughts on this matter.

Let’s get started.

Median House Prices

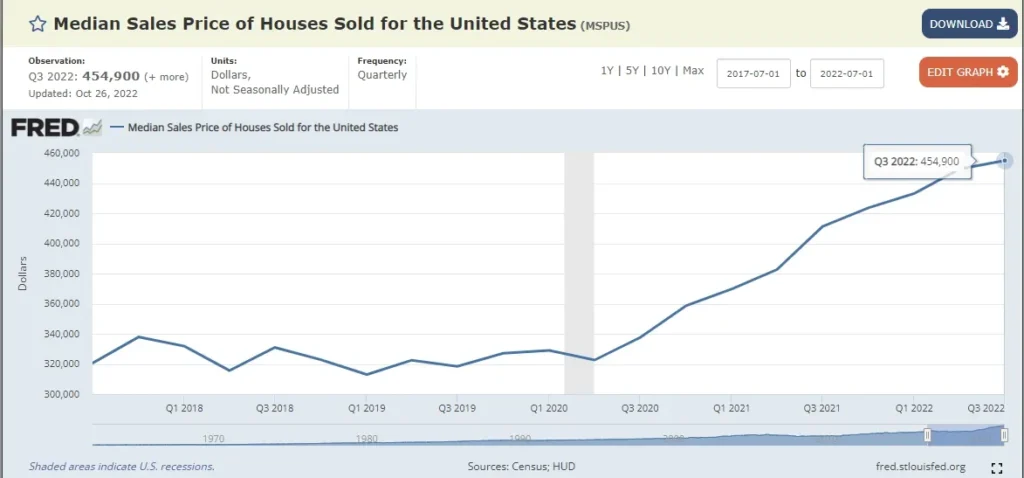

Despite the popular sentiment, do you know median housing prices have not declined as per the last report from FRED?

That’s right, despite all the news, as of October 2022, median housing prices are still on an incline.

This year alone, from Q1 to Q3, January 2022 to September 2022, median home prices have went from $433,100 to $454,900.

See the chart below from FRED.

Be sure to pay attention to many media outlets, because many reports on declines in real estate sales is in respect to volumes and not prices.

However, the ad titles are showing “real estate down 30%…” causing consumers to jump to conclusions and think this is respective of prices.

- As shown above, year-over-year sales are down 28% as reported by Realtor.com

- Not housing prices…

Automatically, people are mistakenly thinking this is reference to the prices.

Yes, there are cities that prices are dropping.

These cities are where housing prices increased the fastest or where primarily luxury model housing is, like in California.

Realtor.com listed the top 10 cities where home prices are dropping the most as of (10/10/22):

- Austin, TX

- Phoenix, AZ

- Palm Bay, FL

- Charleston, SC

- Ogden, UT

- Denver, CO

- Las Vegas, NV

- Stockton, CA

- Durham, NC

- Spokane WA

As mentioned, even with these specific declines, the median home prices are still trending higher as shown in the graph above from FRED.

That means, most housing prices across the nation are still going for the asking prices listed.

However, we are seeing higher days on market for listings.

- As reported by Realtor.com on 11/18/22, days on market is up 8 days from this time last year.

- Median listing prices are up 11.1% overall.

- New listings are down 18%

Housing Inventory

Inventory is the next topic that makes a big difference.

Compared to the peak shown in 2017 below, housing inventory is down 48.6%.

Yes, buyers have backed out since the interest rates are much higher than last year and inventory is still low by a 48.6% margin.

The market will not be considered healthy or balanced for supply and demand until supply is caught up to demand.

See the below data from FRED.

These data points still show favor to sellers, despite all the current market conditions.

- Supply is still in dire need of replenishment.

Supply will play the largest role in market sentiment being rebalanced.

With Fed meetings upcoming in December, and for the new year, we still have several rate hikes to expect. This will continue to diminish buyer demand.

As inflation is the major defining factor, in the momentum of the fed raising rates, we still have a long way to go before we are below 3% inflation.

This leads us to the next factor.

Unemployment

A known target of 6% unemployment, has been stated by several economists.

This shows we are quite a ways off from targets.

Keep in mind, the fed is targeting this rate in order to reduce buyer demand enough to rebalance market sentiment where supply and demand is balanced.

Although, these targets will help reduce demand, housing inventory is still an issue.

Even with achieving less buyer demand, every market will not face negative effects in housing prices.

So let’s share how you can help protect yourself.

Conclusion

Our solution for any buyers in today’s market is to understand the meaning of “location, location, location”…

- In our article, Understanding Location, Location, Location, we review several vital aspects of knowing what you’re buying and your awareness of market conditions that signal strength or weakness.

- We also still support the sentiment expressed in our article, Solutions for Home Buyers in Today’s Market.

These two articles, will be very helpful in guiding you better.

Pay close attention to the population and employment changes in your immediate area.

- Also, consider utilizing an adjustable rate mortgage versus a fixed rate mortgage.

Historically, the periods in which the fed has raised rates in order to rebalance the economy, are usually sharp. Meaning the periods are usually short lived. Therefore, rates are likely to be less than they are today, within 5 to 7 years.

- Also assumable mortgages or buying down points, are other possible means of saving you the money in your cost of borrowing. Assumable mortgages are when you assume the rates the seller already has or financing your purchase under the same interest rates (since the financing is assumable). Be sure to inquire with your real estate agent.

Thanks for joining us faithful readers – future leaders.

We hope this article has been helpful for you.

Love ya and keep striving for growth.

Please comment how you will plan to avoid losing equity in your purchase plan.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.