Our Economic Path Based Upon Real Estate and Stocks

What are the current economic changes to pay close attention to?

There are many things going on today and projections couldn’t be as important as notably seen today.

Between inflation, mortgage rates, unemployment, supply chain and the cost of living, the data points are complex.

Today, we will review a few notable data points and provide our insight on what to keep an eye on.

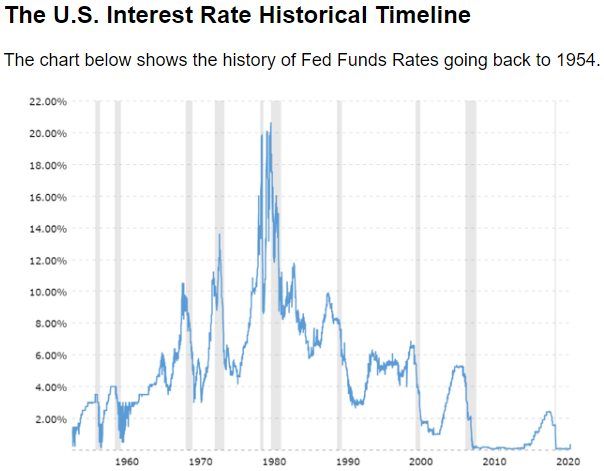

Let’s start with FED rates…

FED Rates

As of recent we have seen rapid increases in rates from the FED to try to reduce the buyer demand and reduce inflation.

Over the last 12-14 years, because of the FED rates, mortgage rates have consistently trended lower and lower until March of 2022.

Below is the history of the FED rates over time.

Although last year, we teetered between news outlets communicating a possible rate hike in mid 2022 or in early 2023, the hike came early. Some say not early enough due to the rate of inflation.

- Per the U.S. Bureau of Labor Statistics, we have went from 4.2% CPI (April 2021) to 8.3% CPI (April 2022) for cumulatively all CPI items.

- At the start of 2021 (January 2021), we were at a CPI of 1.4%.

As an objective of the FED to slow down demand, the supply of housing is a key issue.

Let’s review a few factors related to housing…

Housing

As housing is still under supplied, the current crisis of not having ample supply for home buyers and renters is upon us. The stated shortage, per Realtor.com is approximately 5 million homes throughout the U.S.

With FED rates being raised, more buyers are being forced to wait out their plans to purchase a home.

- For those who are still buying, we still recommend the efforts and strategies expressed in our article titled Solutions for Home Buyers in Today’s Market.

However, home buyers are not the only borrowers. We have borrowing occurring in the stock market which leads us to the next topic related to FED rates.

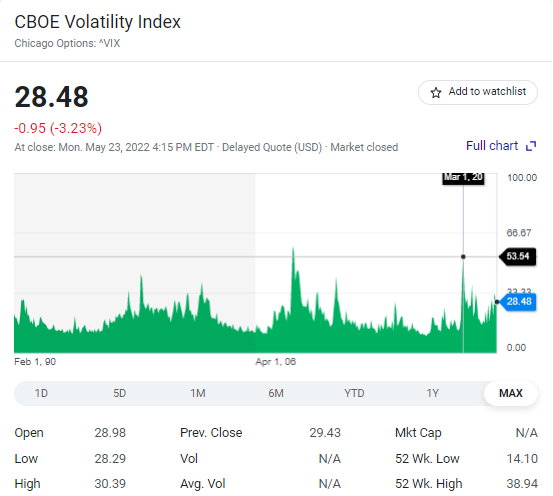

The Stock Market

Since the FED rate hikes ensued, the market has been repositioning it’s value. We are aware that many stock market accounts use margin and the actual rate of borrowing affects the value of stock accounts.

In addition to this, with higher rates, consumer sentiment also changes as it also directly effects stock prices. Both these factors have been showing a strong presence as of recent, as the indexes have been dropping in value consistently.

- See more on these topics on our Stock Market News Page.

As FED rate hikes are planned to continue, we know the rebalance of stock values is not complete. It is very important to pay attention to companies that are showing true signs of strength throughout their quarterly reporting’s this year.

We can also use the CBOE Volatility Index (VIX) to gage market sentiment.

These next few weeks should be very interesting. We saw a peak in the VIX in March of 2020, when the lockdowns started.

- Will we reach those heights again in the VIX? Only time will tell.

Another key point to keep an eye on, is a company’s dependency on stock market investors if the company does not have ample liquid assets.

Although labor is abundantly available, don’t be surprised if some companies will need to reduce labor to support profitability if sales aren’t meeting or exceeding estimates.

An increase in unemployment could be a substantial factor to our economy. Early 2023 will be a key moment in indicating these performances.

This leads us into the next very important topic. Inflation…

This is the second, and equal motive, the FED is trying to accomplish.

Inflation

Inflation is a key topic and is a dynamic force in our ability to produce healthy levels in consumer spending. Consumer spending is all so vital, because the sustainability of our economy relies on the companies that employ us.

Their profitability is our livelihood. As those dollars enter the market, we slowly, but surely, restabilize our economy.

- Let’s not forget that as inflation rises, the dollar has a reduction in value.

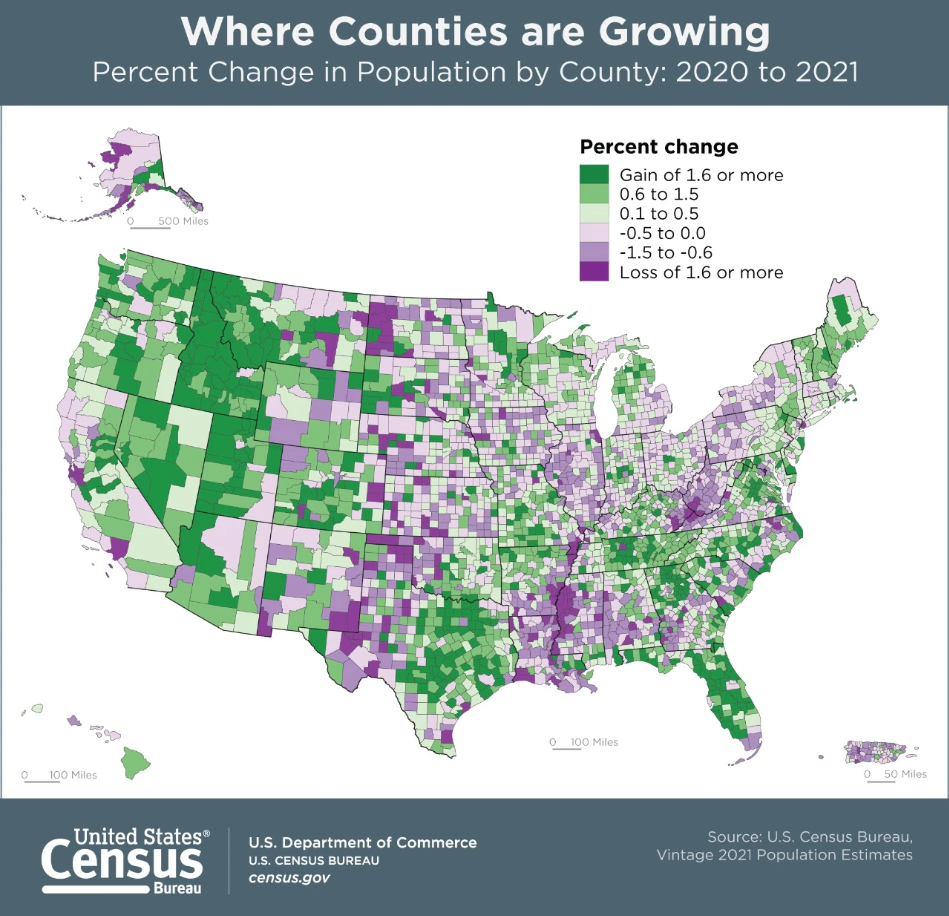

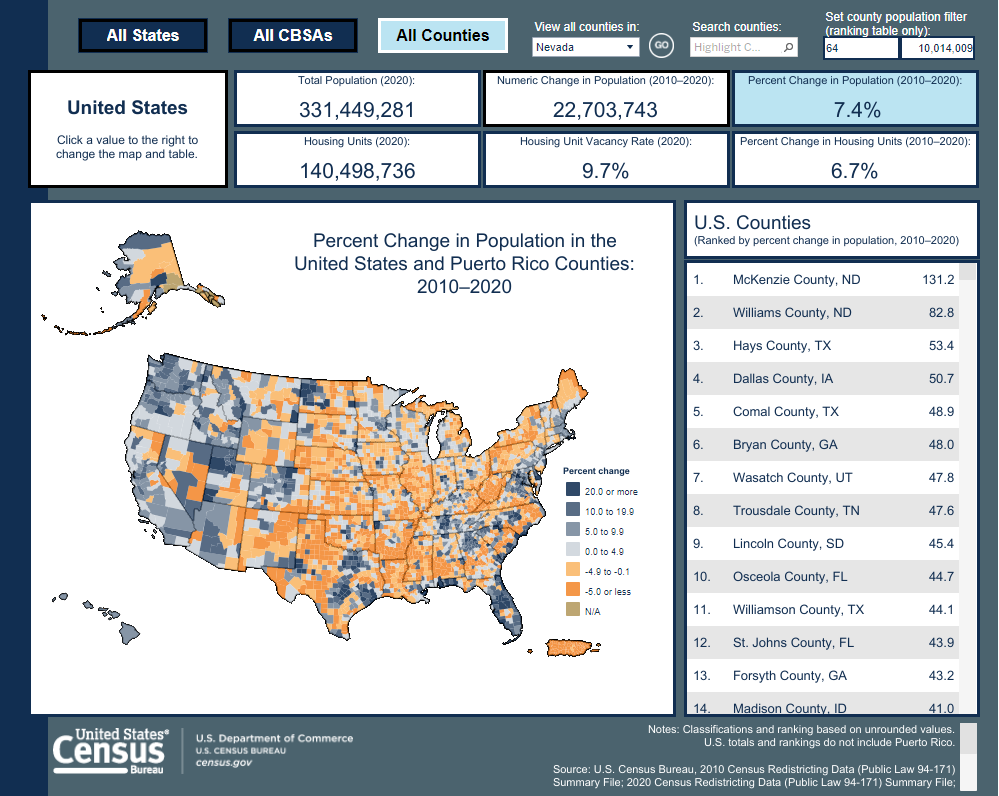

With the emergence of several real estate markets through population growth and jobs, there are several markets that are seeing growth.

See the map below of counties with the largest growth from 2020 to 2021.

Apparently, these locations have also seen the highest increase in consumer product index (CPI) prices.

We will display this as well in a chart from the U.S. Bureau of Labor Statistics.

- In reviewing the largest county population growth from 2020 to 2021, the west and the sunbelt states are definitely leading the pack.

We are seeing significant growth in several counties.

The key from the Census Bureau shows data generated from 2020 to 2021.

Now, let’s review where CPI is seeing the largest increases.

Review the chart and see similar patterns are shown amongst population growth locations and increases in the consumer price index.

Is it possible these markets will cumulatively revive our economy?

Hopefully residential developments lead the way in these locations as well. We know the homes should sell quickly.

Perhaps we will see government incentives in development forthcoming. The stimulus of those incentives should payoff rather quickly.

Hopefully, these areas also see wage growth sooner versus later.

Employment is another key factor in our sustainability and ability to rebound.

Hopefully, we can also sustain healthy levels of employment to generate high production levels throughout supply chain to support our goals.

- Supply chain could be the single-handed, strongest variable in the worlds need to rebound from COVID 19 and inflation.

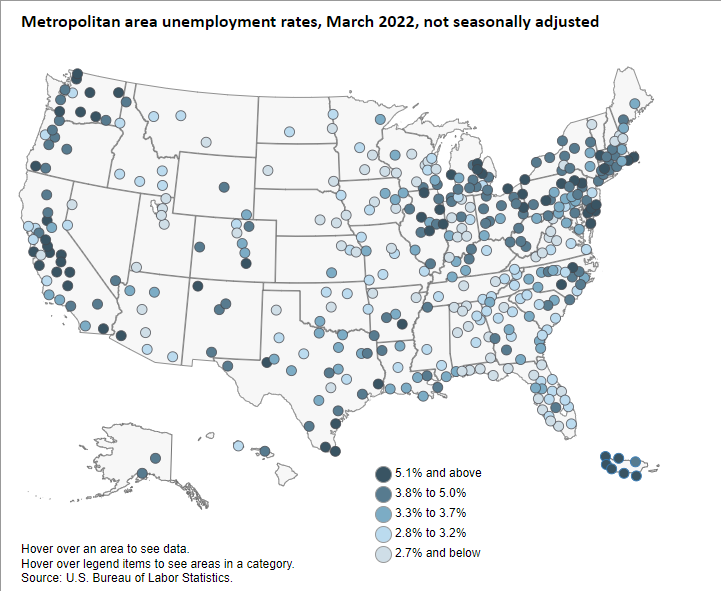

To support the employment idea, also keep an eye on unemployment by location.

With current inflation, the home supply crisis and the FED raising rates, areas with unhealthy levels of unemployment could be areas to pay close attention to.

With the reduction in the value of the dollar due to inflation, we will see a high dependency from people to reside where jobs are abundant.

Locations with decreasing populations could see a uptick in departs in the short and long term.

If you haven’t realized, investing is highly effected by data.

Despite companies fulfilling labor demands to support their success, this is an era packed with change.

These times will show us what companies will survive.

See our article The Era of Change & Investing to learn more on this topic.

In this article we cover several aspects of how the investment world is transitioning.

Several of the topics discussed today, will directly relate to our forward progression towards change.

Conclusion

Sustainability, innovation, demand and change are all characteristics of this market.

Although there are many variables to monitor, there is strength in the market.

We will see where all the excess cash, and pent-up demand, will land.

A major component to seeing improvement will be within the production levels and efficiency of supply chain.

Thanks for joining us today faithful readers – future leaders.

Love ya and keep striving for growth.

Please comment what you think the market will do over the next year or two.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.