How is the U.S. Housing Market?

You may be wondering, how is the overall real estate market performing in the U.S.

Keeping track of the market’s performance is important for buyers and sellers.

A “turn” in the market has been predicted countless times in the last 2 years.

- Despite all the housing market crash propaganda, it has been far from the truth.

However, there have been declines in prices and there have been increases in prices.

With the Spring and Summer months being the most active, current performances can tell you where there is strength and where there is weakness.

- In The Best Time to Sell a House, May, June and July are indicated as the busiest months.

As cited from Redfin.com, we will review housing data as of June 2023 for each state mentioned.

Let’s get started.

States with 5%+ Increase in Sales (Year over Year)

- Connecticut – 8.9% better than last year.

- New Hampshire – 8.1% better than last year.

- Nebraska – 6.9% better than last year.

- Rhode Island – 6.8% better than last year.

- Wisconsin – 6.7% better than last year.

- New Mexico – 6.2% better than last year.

- New Jersey – 5.4% better than last year.

- The blended average days on market for these seven states are 27 days.

Note: There are 25 states who’s year over year results are between 0% – 5% better than last year.

- The blended average days on market for these 25 states are 26 days.

Do you think these states will continue to see increases through the end of the year?

Now let’s review states with declines in sales prices year over year.

States with Decreases in Sales (Year over Year)

- District of Columbia – 16.4% worse than last year.

- Idaho – 6.6% worse than last year

- Louisiana – 5.8% worse than last year

- New York – 3.6% worse than last year

- Colorado – 3.5% worse than last year

- Hawaii – 3.5% worse than last year

- Arizona – 3.1% worse than last year

- Utah – 3% worse than last year.

- Oregon – 2.7% worse than last year.

- Texas – 2.6% worse than last year.

- Washington – 1.9% worse than last year.

- California – 1.1% worse than last year.

- Florida – 0.33% worse than last year.

- Vermont – 0.26% worse than last year.

Note: There are 15 states who’s year over year results are worse than last year.

- The blended average days on market for these 15 states are 35.5 days.

Also, among these states, are the states with the highest amount of housing inventory.

- Louisiana, New York, Hawaii, Utah, Texas and Florida all have 3 months of housing inventory.

Sad to say, but yes that’s the highest amount of inventory for any state.

- Data was not available for Montana, North Dakota, South Dakota and Wyoming.

For past hosing data reports, see the following articles:

- See How Housing is Doing in States with Highest and Lowest Inventory Levels (February 2023)

- Real Data in Housing Market Results (December 2022)

- What Direction Will Housing Prices Go? (December 2022)

- How is the Residential Real Estate Market Trending Today? (November 2022)

- How Current Housing Data Will Affect Future Sentiment (May 2022)

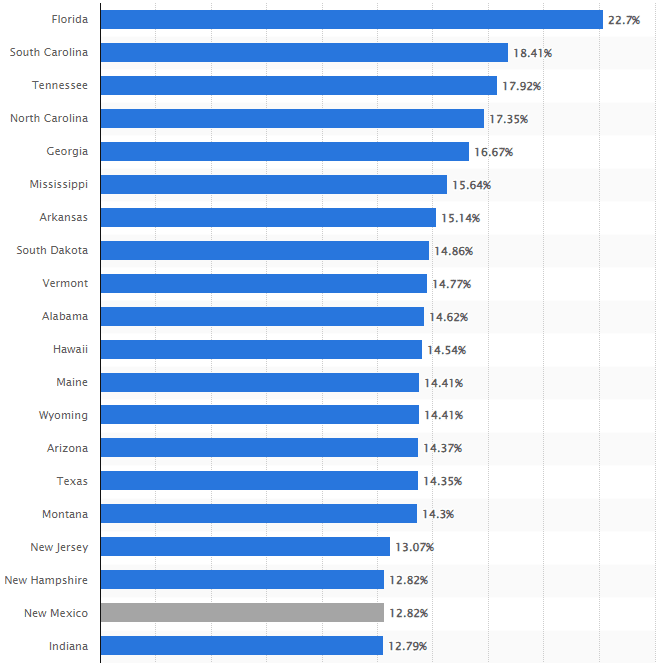

Courtesy of Statista, here are the top states for housing price growth in 2022. Note all 50 states had price increases in 2022. Follow the link above for all state’s data. We only show the top 20 below.

Conclusion

Notice many states in the west and south, that grew rapidly after the pandemic, are seeing the most declines. The only state which isn’t is New Mexico.

With only six states having three months of inventory, which is still very low, all other states have two r only one month.

These inventory levels that are not healthy for a balanced market.

- The seller’s market continues.

When interest rates drop and buyers return, housing prices will see increases yet again.

The supply issues we currently have will cause the sellers market to continue to spike until inventory levels are matched closer to buyer demand.

As a buyer or seller, paying attention to inventory levels can be helpful.

- Buyers should target markets where inventory is closest to being balanced. A balanced (supply-demand) market is 6 months of inventory.

- Sellers should target selling when inventory is lowest to create the most competition.

Thanks for joining us today faithful readers – future leaders.

We wish you great success. Love ya and continue to strive for growth.

Please comment which state is your favorite.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.