Where Do You Anticipate the Real Estate Market Going in 2023?

2023 is going to be an interesting year.

We are starting off on the right trend with inflation declining.

However, the inventory issue will not be resolved anytime soon.

Once interest rates are back down, the builders will get started.

But until then, we must wait.

Multifamily developments have been going on and they will continue to.

However, single-family is what everyone anticipates and awaits.

What are your thoughts on how 2023 will go?

Today we will discuss, current inventory levels by state, the path of inflation, unemployment, interest rates and when we can anticipate a rebound.

- We will expand upon some data we shared in prior articles, True Housing Market Results and Unemployment Trends & Emerging Markets.

Let’s get started.

Inflation

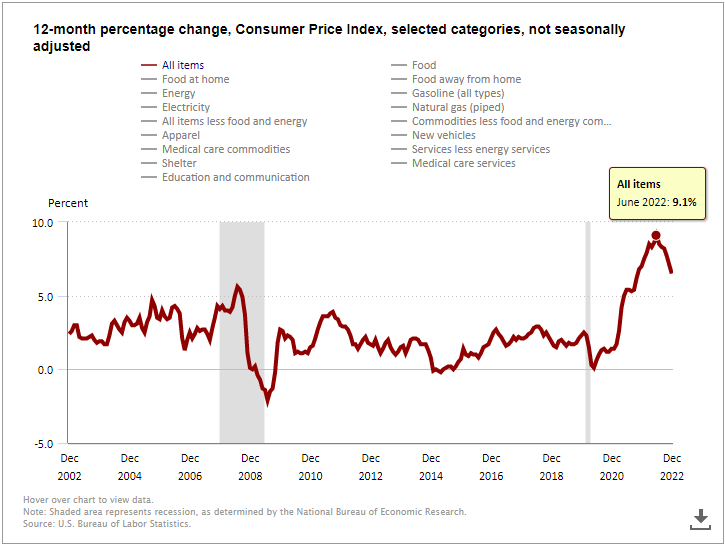

As shown in the latest CPI report from earlier this month (courtesy of bls.gov), the trend of inflation declining has continued.

We have progressively declined each month since our peak in June 2022 of 9.1%.

We are currently at a 6.5%.

We’ve achieved a 2.6% improvement over 6 months.

This is a great improvement.

If we continue on this same trend, we should be back down to under 4% by July of 2023.

If we continue this trend, it would make sense that we could see a fed pivot over the next 6 to 9 months.

Once a fed pivot happens, the builders will follow suit, and begin new construction projects for single-family homes.

Once new inventory enters the market, this is when we will truly see if the prices of old will hold, increase, or decrease in value.

Unemployment

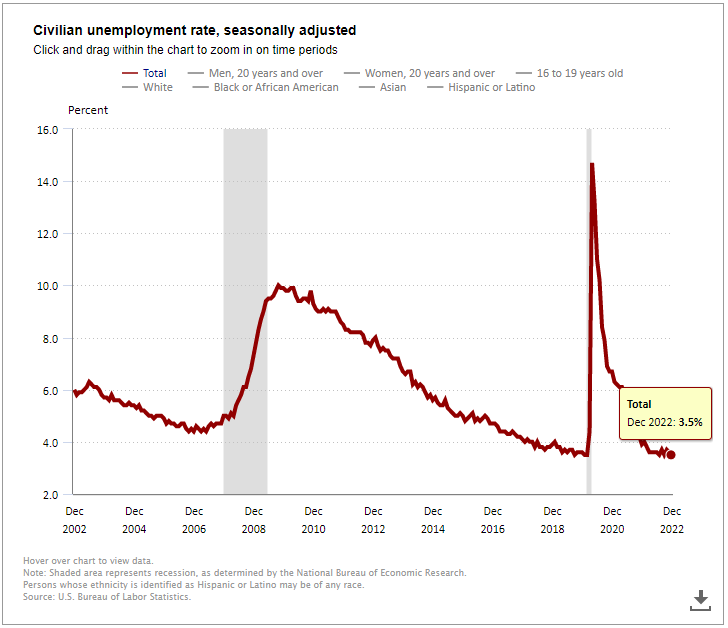

The next indicator, showing the objective of the fed rate has been effective, is within the rate of unemployment.

As of December, we have revisited our September rating, of 3.5%.

This shows that unemployment has trended down and not up as intended.

Since October 2022, the unemployment rate has dropped 10 basis points each month from 3.7% to 3.5% respectively.

It will be important to see year-end earnings reports and what companies may need to do to stay profitable in regards to layoffs.

We all know the fed’s objective is for unemployment to increase.

Just this week, Google announced 12,000 layoffs.

- See the release here on our Stock Market News page this week.

- Microsoft also reports earnings today 1/24/23 after market close.

Technology is one of the hardest hit industries in a market downturn and possible recession.

If the unemployment begins to meet expectations, we can only expect the fed to pivot sooner, provided inflation continues on its current down-trend.

If the unemployment rate doesn’t increase much (or to a target rate of 4.5% or more), we can only expect interest rates to stay higher and/or increase.

From the aspect of unemployment, I see unemployment factor as being more challenging to accomplish.

The economy has been very strong and to pivot from such strength, will not happen quickly.

From this aspect, my sentiment is that the length of time to correct inflation will take closer to 9 months versus 6 months.

If we are able to get inflation under 4% this year, it will be a nice improvement considering all factors.

Current Inventory

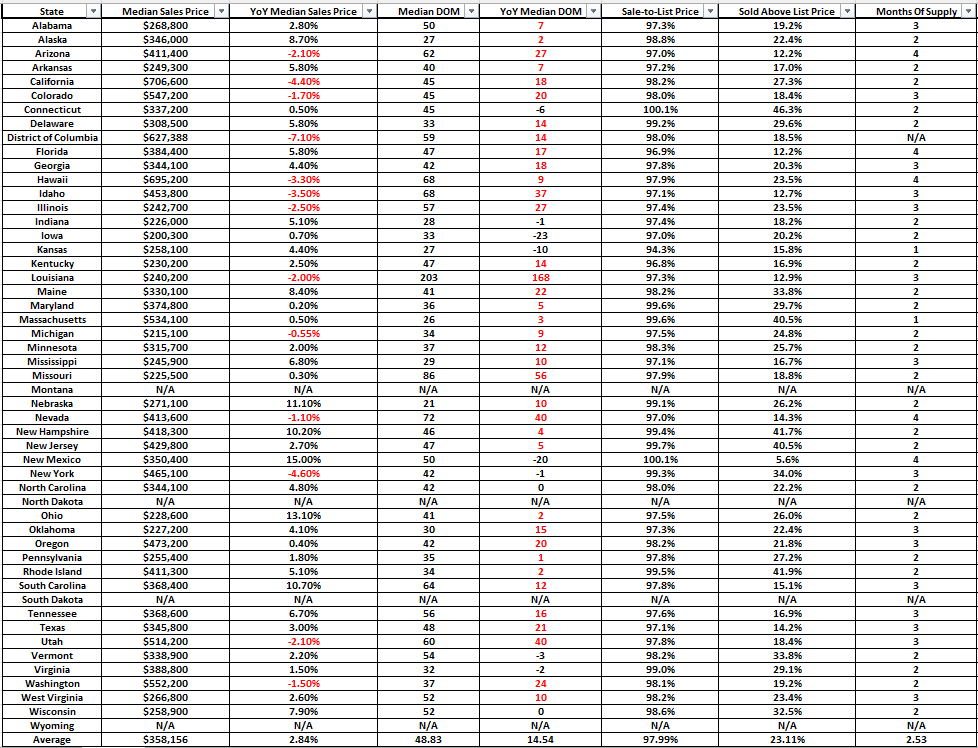

Lastly, let’s touch on the current real estate inventory volumes by state.

Seeing this data can help you determine where prices are more likely to increase, remain flat or decline.

Of course, demand will stay play a significant role in every location.

However, supply is still a major component.

State Chart – Current Stats – Data retrieved using Redfin.com

The following states have four months worth of residential real estate on the market:

- Arizona

- Florida

- Hawaii

- Nevada

- New Mexico

The following states have one month’s worth of residential real estate on the market:

- Kansas

- Massachusetts

Overall the nation’s inventory level is at 2.53 months worth of supply according to the data available.

At four to six months of supply, it is considered a healthy amount of inventory, where buyer and seller demand is balanced.

Looks like 2023 will be an interesting year.

Thanks for joining us today faithful readers – future leaders.

Love ya and continue to strive for growth.

Please comment your thoughts on how you think 2023 will go.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.