Direction of The Housing Market Prediction

What is your prediction of the short and long term housing market?

There are many opinions out there and many people are indecisive because of the variance in direction.

Home buyers today are having a rough time, to say the least.

The housing market is in a historic moment whether we acknowledge it or not.

What is happening today will have decade long effects.

We will also see several peaks and valleys even after the fed has completed raising rates.

So what are the key indicators to pay attention to and where does the logical path lead us?

Today, we will discuss several predictions and market indicators that will play a major role in the direction of where housing is going.

Let’s start with inflation…

Inflation

Inflation is a hot topic today as we’ve seen inflation initiate it’s presence at the start of 2021.

Many were not acknowledging the change in the weights and measures of gross domestic products (GDP), but they were already being altered.

Many products had received reductions in weight, although the package size remained unchanged.

For example, a box of cereal of may have dropped from being 19 ounces to 18 ounces without you noticing from not reading the weights and measures.

The labor shortage has been an ongoing issue for 2+ years and companies made alterations to rebalance weights and measures to counter potential losses due to COVID 19. This is a worldwide issue and prices must continue to rise until budgets can be balanced with the shortage of products.

Primarily due to the lack of labor, companies must make these changes effective to stay profitable (or in business).

The next factor that is affecting inflation is the obligation to recoup funds given away by the government in the stimulus checks that were issued.

The stimulus checks allowed us to sustain hardships, but those funds must be recovered. Those funds will also be recovered with interest.

Overall, we will continue to see inflation rise until labor affords the demand and funds are recuperated from the stimulus bill.

Interest Rates

This leads us to interest rates. Another hot topic…

Interest rates are a hot topic because it is directly tied to the cost of real estate (and the cost of borrowing).

Many home buyers are indecisive on whether they should wait because the media keeps talking about a “housing crash,” while others are trying to buy as soon as possible.

Waiting will only afford you less house in the long term because interest rates will need to go up substantially for the U.S. economy to recover.

- I predict rates will go up to at least 5-6%.

We are currently approaching 4%. Which were the rates in 2009 when the market crashed due to predatory lending practices.

4% is not enough to compensate for what needs to be recovered today. So, I predict rates being minimally where they were in 2006/2007 before the crash.

Could rates go back up to 7-8%? It depends on labor issue corrections and housing supply. But yes, I think so.

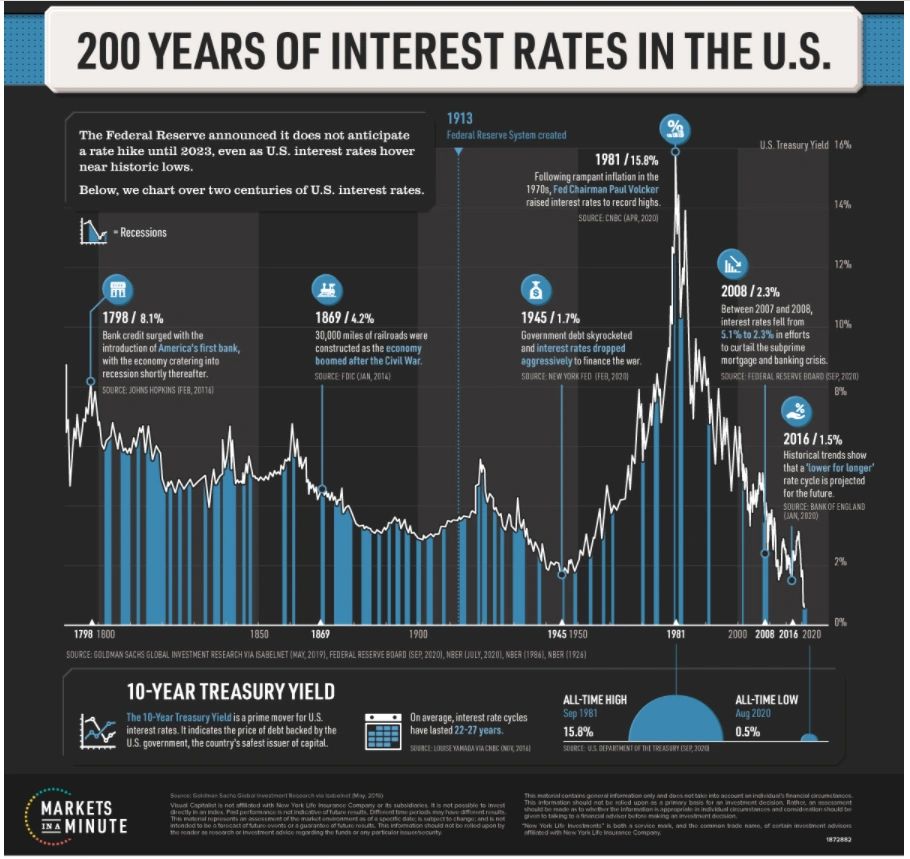

See the chart below on the history of interest rates or here.

Also see these articles as this isn’t our first time speaking on this topic. Real Estate: Inflation, Economy & Sentiment & Solutions for Homebuyers in Today’s Market are great articles to review.

Our sentiment in our article titled Solutions for Homebuyers in Today’s Market published October 5, 2021, remains the same. If you are a home buyer seeking a new home, I recommend reading this article.

Construction

This leads us to construction. Construction is a major component that will directly effect the real estate market in the long run.

It has been advertised by several creditable sources that the housing market is short on supply by over 5 million homes. Historically, new builds have averaged between 1-2 million per year.

See Number of Housing Units Built in the United States from 1920 to 2019 here for more insight on historic rates of development for housing.

The dilemma today, since labor is difficult to place and interest rates are not stabilized, builders are finding it very difficult to guarantee the cost of a new home build for their clients.

As the fed begins communicating their rate increases and the anticipated increases per year, the developers will be able to plan better.

This has begun and developers are initiating more new builds then they have in the past few months.

My prediction is that labor will continue to be a bottleneck for at least 6-12 months and construction will not start massive production until the labor/supply issue is corrected. Supply chain cannot be a pending issue with home building expected to set it’s course.

On a side note, related to remote working, many corporations have yet to publicly express their sentiment and plan.

Many wage increases and bonuses have been issued, but no structural business plan has been expressed on the new on ratios of on-site employees versus off-site employees.

This is a hot topic and creating a plan to insure our corporations, which supply the jobs, have a sustainable plan, is crucial to the economy.

Companies are being very careful as this is a fragile topic with COVID 19 being the hot topic with cases continuing to plague the world.

I think many companies are waiting to express their planning when COVID cases subside.

It would be favorable for them to wait and express their sentiment then, and not now.

Especially if they cannot support high levels of remote employment. Whether company culture can be upheld, with people working from home, is still unknown.

Foreclosures

Next hot topic…Foreclosures are underway, but at what volumes, is still unreleased.

Foreclosures usually take years before they actually hit the market. The process takes time and the banks need to reach the conclusion that they will offer them on the market.

It would make sense that banks are sitting on high asset values with the increase in real estate values and holding could be in their best interest if they have already received their profit, usually realized in the first 7 years of the mortgage.

So even if banks are sitting on heavy foreclosures, the age of the mortgage, the condition of the home and the banks balance sheet, will play a huge role in if/when those assets will hit the market.

If/when they do hit the market, I predict it won’t be until 2024/2025.

This could have a positive impact of housing supply, but it is undetermined, by how much, at this point. Forbearances are coming to their ends, so for many banks the foreclosure clocks have begun.

Time will tell, as data begins to be released in this respect.

Peak & Valleys

The variance in value peaks and valleys is another hot topic…

The peaks and valleys of home prices is still underway. The peaks are still being created and the valleys are yet to be determined.

There are several factors to consider when discussing the potential of housing prices increasing or declining.

Mostly, these factors are dependent on housing supply and interest rates.

Supply & Interest Rates –

Housing supply is nowhere near seeing a dramatic increase in the near term. Therefore, interest rates would need to reach a point where it really affects the buyers potential on affordability. This is in respect to a short term outlook…

At a purchase price of $150k, with taxes at $2,000, insurance at $1,000 and a 3% down payment, the variance in the mortgage payment is as follows:

- At a 3% interest rate, payment is $924.

- At a 5% interest rate, payment is $1,092.

- At a 7% interest rate, payment is $1,279.

As you can see at 5% the payment increases $168 per month and at 7% the payment increases $355 per month. I think at difference of approximately $150 per month, home buyers will be affected and will need to either have more funds available or buyer a cheaper house.

This will begin the breaking point. Buyers who are not satisfied with lower cost options, will be forced to rent.

Therefore, my prediction is that home buyers will not slow their rate of buying until rates are at about 5% or more. This means housing prices can and will likely continue to rise until that time (if supply doesn’t substantially change prior).

As mentioned, peaks have not been realized quite yet. However, there will be case-by-case scenarios with individual city’s, that will have their own cycles, based upon the demand to live in their city.

Meaning, some cities will see declines before others and some cities will continue to see prices increases when others flatline or decline. There will be variance even at the 5% mark and above. This is the nature of real estate.

Even if interest rates are at 10%, locations will still appreciate based upon demand. This will always be a given because that’s the beauty of real estate.

- See our article titled Understanding Location, Location, Location, for more visibility on this topic.

Buyers vs Renters

It is inevitable that renters have and will continue to increase. This brings about our next hot topic…

Due to the difficulty buyers are having with finding affordable real estate, renting will be high for the near future.

I feel for Millennials and GenZ, because it is very unfortunate that they are not able to embark on their quest to start their real estate journey due to the current dilemmas in the housing market.

As housing begins to develop throughout the country, home buyers will have their chance to begin their real estate investment journey. In the meantime, renters will be high.

I predict that although there is a pleather of renters today, as housing is produced, there will be a “mad dash” where many renters will become buyers. Depending on the demographics of the market and the profile of many renters, many landlords and cities will see an exodus from renting at some point over the next 5-10 years. Many renters are very temporary. The buying demand has been “pinned up” for at least two years and that “pressure” will be released sooner or later.

This could be possible in cities with higher levels of younger renters that include those Millennials and GenZ residents.

Conclusion

For now, only time will tell. These are our predictions…

Thanks for joining us today faithful readers – future leaders!

We hope this article has been helpful.

Love ya and continue to strive for growth.

Please comment your predictions on the housing market or how the market has affected you.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.