Learn Methods of How to Evaluate Stocks to Buy

What is your process when you are evaluating whether to purchase a stock or not?

Do you base your decision upon what everyone else is doing or do you research the company to know what you are buying?

- Afterall, when you purchase a stock you are giving your money to that company, with an expectation that they will provide a return on your investment, based upon their company’s ability to grow.

- That’s if you are making your trades as long positions.

Those of you who are shorting positions, your sentiment is the opposite.

Meaning, you think the company is declining and you’re willing to invest your money with the expectation that the company will not meet performance metrics (or that the stock price will go down due to other causes).

In today’s article, we will review a step-by-step process in how to evaluate if a company is worth investing in for future growth.

Let’s get started.

1) Foundation

To start, you definitely need an understanding of how the stock market works.

We will not attempt to educate you on that in this article.

Primary dictators in how a stock gains momentum, regardless of the direction, is by:

- Volume

- News

- Performance

These factors contribute the most to the daily performance of a stock’s momentum.

For those traders out there, you understand the necessity to have a reliable platform to conduct your trades.

I personally like and use Thinkorswim.

However, when I’m reviewing a stock, my first stop is Finviz.com

- Finviz is the most comprehensive and well equipped website I’m aware of.

- It provides ample information and tools for you to evaluate any stock and the market.

Be sure to check it out when you can. There may be questions that arise, but that’s a good thing.

Anything that triggers questions, is the catalyst to growth.

- Finviz is a great source to review a stock’s technical performance, analyst ratings, next report date, current volume, average volume, P/E ratio, average trading range (ATR), relative strength index (RSI), insider ownership, target price, market cap and a link to the company’s website.

- Another key indicator to review is, how the stock is performing relative to it’s simple moving averages. The SMA20, SMA50 and SMA200 are all important indicators you should be familiar with.

Yes, I know. That is a lot.

But yes, these are all things I review.

This leads us to our next topic.

2) Technical Analysis

In a snapshot, I first like to see how the stock is performing from a technical analysis standpoint.

This means I am familiar with chart analysis and indicating chart patterns.

This is very important in understanding, technically where a stock may go next, solely based upon the chart analysis, news and volume.

To get familiar with technical analysis, I recommend Charting and Technical Analysis by Fred McAllen as reading material.

This book is very helpful at educating you on how to identify chart patterns.

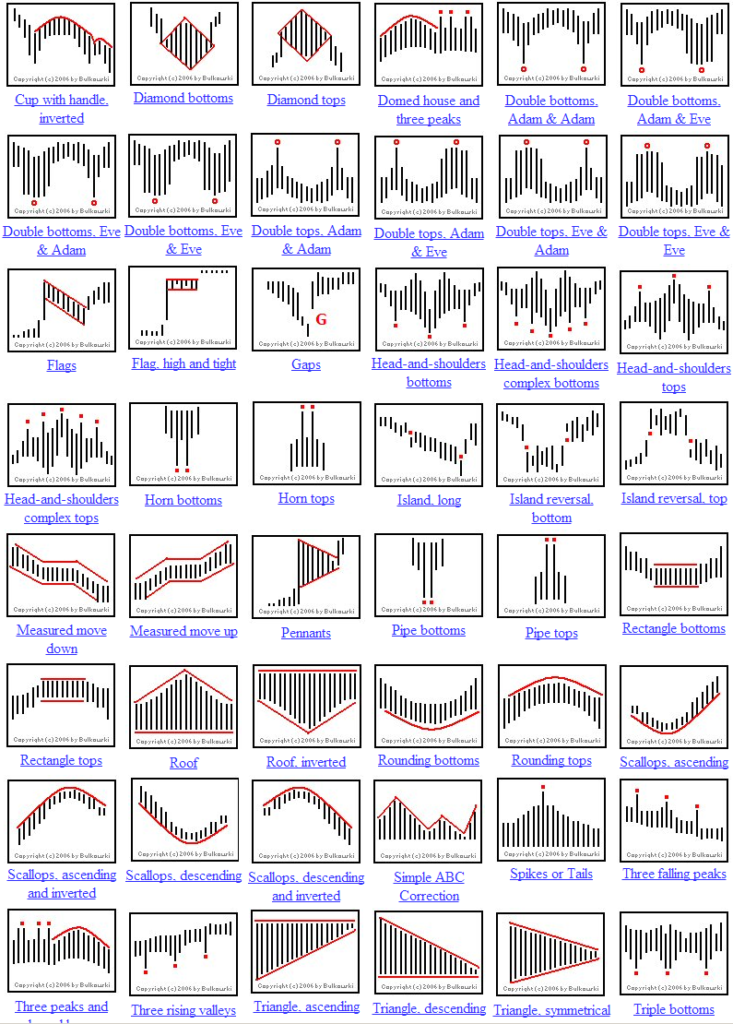

Although, this may seem complex right now, below is a good reference chart to the many patterns that may display themselves when reviewing a stock’s chart (or technical analysis).

These are reviewed in Charting and Technical Analysis by Fred McAllen.

But, to display what chart patterns are, I want to provide a reference chart so you understand what is being referred to.

Chart Patterns

- See the below diagram.

These are several chart patterns that you may see.

Once you review these and begin looking at stock charts, you will begin to identify these patterns.

They all can be very helpful in understanding the potential direction of a stock’s price.

However, there is another key point I want to include that I use regularly.

3) Support and Resistance

Although, I definitely identify the stocks current chart pattern being displayed, more than anything, I also always identify the key levels of support and resistance.

- These are price points that have been visited and revisited, several times within the stocks history.

- These price points are indicators to where the stock has broken a level and either continued up or down.

These levels are identified by simply increasing the time span of a chart accordingly, and drawing the horizontal lines, where the stock has revisited ample times.

You should identify these levels over short and long-terms to identify what price points are major identifiers, which are recent and which are both.

Here is an example of what identifying support and resistance levels may look like.

This leads us to our next topic.

4) Fundamental Analysis

The next portion of data I like to review is the trend of P/E (price to earning) ratios over a long period of time.

When you review years worth of chart analysis, you cannot disregard “the why” behind the movement in the stock’s price.

- You can only get familiar with this by reviewing the yearly earning reports or 10-K’s.

- In the 10-K, sometimes the company identifies their P/E ratio for that year and sometimes you will have to compute it yourself.

Regardless, you want to get several years of the P/E ratio to determining if the stock is priced high or low currently.

- The P/E ratio is simply the stock’s price per it’s earnings.

- A lower P/E ratio amount means the stock is priced cheaper compared a P/E ratio that amounts to a higher number. Seeing the trend of how the stock has been priced over ample years, helps identify the current price for the stock.

This plays a significant role in determining the price point you’d prefer to buy the stock at.

- You can also use this data to compare it to the company’s competitors.

Use the competitors P/E ratio to compare to the company you are evaluating and determine if the stock is priced high or low.

5) Conference Calls & News

The last portion of data I like to review, is what the company has to say for itself.

- The company’s past performance, future performance plans and what their sentiment is on key financial aspects of their company’s performance, is reviewed in these calls.

- You can determine if the information you receive is causing you to agree or disagree with the company’s current sentiment.

Combine this information, with analyst’s sentiment and current news, to determine your stance.

Comprehending what a company is doing well in, where they are struggling, and how they will meet their targets, are all very important factors to decide if you’d want to give your money to them as an investment.

These are key factors in collecting ample data to determine your next stock investment.

We hope this article has been helpful for you today.

Thanks for joining us faithful readers -future leaders.

Love ya and continue to strive for growth.

Please comment your routine for evaluating stocks.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.