Unlock Real Estate Success – Master the BRRRR Method with Our Exclusive Calculator!

Revolutionize Your Real Estate Strategy with the BRRRR Investment Calculator

Are you ready to take your real estate investments to the next level?

Say hello to our BRRRR Investment Calculator – the essential tool for mastering the Buy, Renovate, Rent, Refinance, Repeat method.

Learn how this powerful tool can transform your approach to real estate investing.

Understanding the BRRRR Strategy: A Comprehensive Overview

Dive deep into the BRRRR strategy and discover why it’s a game-changer for real estate investors.

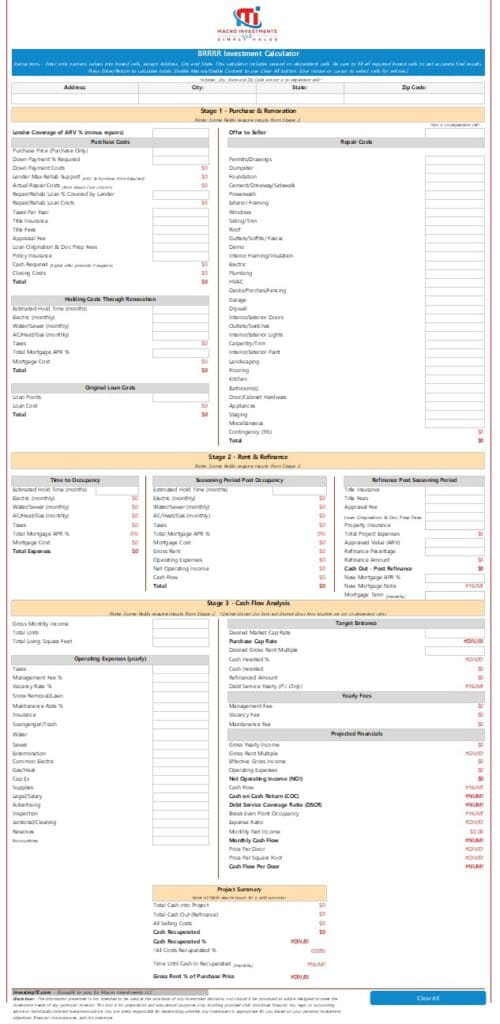

From evaluating entrance prices and renovation costs to assessing cash flow and return on investment, our calculator guides you through every step of the process with precision and clarity.

The Importance of Detail: Why Every Evaluation Matters

Learn why attention to detail is crucial when implementing the BRRRR strategy.

Our calculator provides comprehensive insights into each aspect of your project, ensuring that nothing is overlooked.

With detailed line-item repairs and customizable metrics, you can make informed decisions and optimize your results.

Unlock Your Full Potential: Features of Our BRRRR Investment Calculator

Explore the advanced features of our BRRRR Investment Calculator and see how it can revolutionize your real estate projects.

From inputting lender leverage ratios to evaluating renovation costs and cash flow projections, this tool provides everything you need to succeed.

Plus, with full visibility into every aspect of your project, you can collaborate effectively with your team and maximize your returns.

Invest in Your Success: Get Your BRRRR Investment Calculator Today!

Ready to supercharge your real estate investments?

Purchase our BRRRR Investment Calculator for just $16.99 and unlock the key to success.

With its user-friendly interface and powerful features, this tool will become an invaluable asset in your investing toolkit.

Don’t miss out – get yours today!

BRRRR Investment Calculator Features

BRRRR Investment Calculator Features

- Full visibility to each line-item repair within your scope of work.

- Ability to input lender leverage ratios that determine if thresholds meet expectations – knowing if you’ll need to bring more or less cash to closing.

- Evaluate all your costs from renovation, to renting, to closing with your long-term loan product.

- The ability to determine if your product will cash flow.

- Illustrate all considerable metrics to determine if targets are met.

- See your rates of return, cap rate, cash flow and recuperated capital.

- Ability to display the detail within every portion of the project for better engagement, learning and partnership purposes.

Transform Your Real Estate Career with Our BRRRR Investment Calculator

Say goodbye to guesswork and hello to precision planning with our BRRRR Investment Calculator.

Whether you’re a seasoned investor or just starting out, this tool will help you achieve your financial goals faster and more efficiently.

Invest in your success today and watch your real estate portfolio thrive.

BRRRR FAQ

What is the 70% rule for BRRRR?

The 70% rule is in reference to your entrance strategy. The 70% rule formula, or 70% of ARV (after repair value), minus repairs, provides a entrance that helps support your original loan being paid off at the point of refinancing.

- If you enter at 70% of the ARV minus repairs, and your ARV and repair estimates hold true, you should not have trouble refinancing at 75% or 80%.

Be sure your DSCR (debt service coverage ratio) also meets the expectations of your lender before taking on the project.

What is the 1% rule in BRRRR?

The 1% rule is a ratio formula that references the gross monthly income to the purchase price of the property, respectively.

- If gross rent is $1,000 and the purchase price is $100,000, $1,000 of $100,000 (or $1,000/$100,000) is 1% ( or .01).

Using this rule, you’d take the future projected rent, post renovation, and the refinanced amount, to see if it meets the 1% rule.

How much do I need for the BRRRR method?

Always confirm costs with your lender.

Here are some likely out-of-pocket costs to plan for:

- Down payment at entrance.

- Closing costs at entrance.

- Renovation funds for the draw process.

- Holding costs during the renovation.

- Holding costs throughout pursuit of tenant occupancy and the seasoning period (as applicable).

Use the BRRRR Investment Calculator for exact figures.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.