What are the Top 5 Concerns in Our Economic Health?

Where do recovery needs exist in our economy?

With so much going on, there is a need to stay connected to the key concerns.

We know COIVD-19 caused many changes.

Some of those changes have caused rapid forward progression and other changes have caused high-level recession worldwide.

What would make your list for the top 5 economic issues today?

Join us for a discussion on our top 5 topics.

Let’s get started.

Pre COVID-19 Conditions

Before we can talk about today’s issues, we must look at the state of the market prior to the pandemic. We all know pre-existing conditions matter greatly on future planning.

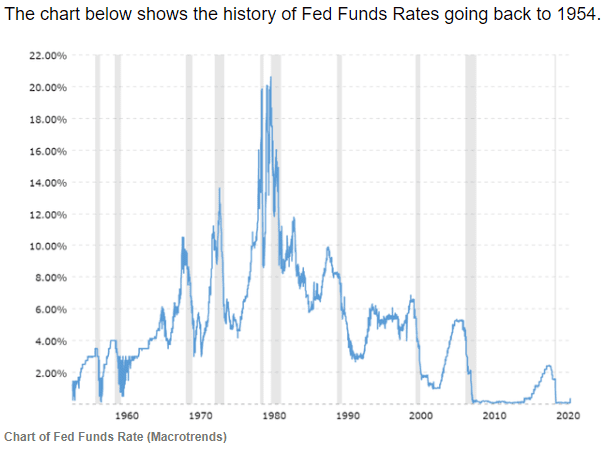

Within a balanced economy, there is always a flow of money controlled by central banks and interest rates.

If we take a look back at the last 15 years, we will see that interest rates have consistently stayed at historic lows.

- The Great Recession, from December 2007 to June 2009, where the peak unemployment was 10% (October 2009), the GDP was down by 5.1%, and being the longest documented recession since the Great Depression (March 1929 to March 1933), we had plenty to recover from.

Hence, the low interest rates we’ve seen after the Great Recession, to help begin setting a precedence to restimulate the economy.

- The subprime mortgage crisis that led to the housing bubble is a memorable time. We also saw oil and food prices soar, the collapse of many financial institutions like Bear Stearns, Fannie Mae, Freddie Mac, Lehman Brothers, AIG and the automobile industry.

- Consequently the government contributed a $700 billion bank bailout and contributed $787 billion toward a fiscal stimulus package.

As shown below, (Courtesy of seekingalpha.com), you can see the history of interest rates prior to the Great Recession and after.

Seeing this data, it is evident that a recovery period was needed.

Per-COVID-19, as the market gained it’s strength and our economy was performing strongly, COVID-19 arose. This brings us to today.

Now, let’s review the effects of COVID-19 and the primary issues we need recovery from today.

Industry Wide Supply Issues

It isn’t spoke on as much as it should be, but the predominant issue causing our inflation is supply. No matter the industry, supply is the culprit.

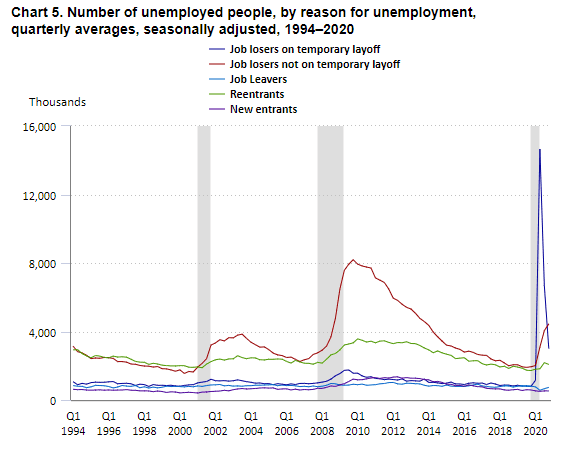

COVID-19 definitely caused the lack of labor due to stimulus money, unemployment pay which peaked to 13.0%, lockdowns, and intermittent reopening’s.

The stimulus and unemployment payments caused a low-level need for employment amongst employees.

However, employers faced huge setbacks, if they survived, due to the lack of employment fulfillment.

With the lack of ability for employers to fulfill employment roles, every reopening caused supplies to diminish due to supply chain issues.

- Supplies were being sold at a faster rate than replenishment.

This brings about the next issue…

Inflation

Inflation began to show itself rather quickly as we were well aware of the employment issues.

Many employer based payment incentives began. Pay raises and even hiring bonuses became very popular.

Never have we seen fast food employees get hiring bonuses as well as starting pay of $14/hr. or more.

In addition to paying more in labor expenses, employers could not keep up with supply demands. So, product prices began to increase. Some inflation wasn’t noticed right away because some products had similar package sizing, but the quantity had been reduced.

Many consumers, don’t take notice when an item is the same price, but the quantity of the product has been reduced. This often happens with products that are boxed and/or have a container. The container is often the same size (or very close), but the contents are reduced.

Regardless of how it was implemented, inflation had arrived.

Inflation will not subside until supply lines have caught up.

This is why the fed is raising rates. So, we slow demand and allow time for recovery in the market.

This brings us to the next topic.

Production

Even when supply has began to keep up with inflation, supply chain and production levels will need to keep pace with fulfillment.

This is when production levels will need to be consistent with throughput and replenishment.

We’ve had a little feedback on supply chain bottlenecks the industry is facing.

- A bottleneck in operations works the same as a physical bottle. The narrow neck reduces the rate at which water flows out, and causes backup behind it. Bottlenecks cause major interruptions to work productivity by delaying the production process and failing to keep up with replenishment demands.

Currently, the U.S. has 11M jobs that are unfulfilled. Whether a product is an import or an export, the production levels to support inbound and outbound levels will be very important at having a swift recovery.

It is evident that many companies are, from a quarter of a year, to years behind, in estimated sales post COVID-19. These sales are supported by product supply.

When you equate the sales, to the amount of products needed, you’ll see that the recovery measure is grand from a supply perspective.

These backlogs will need swift recovery if we expect a swift rebound.

Immigration

The U.S. has always been successful from it’s ability to support diversity and inclusion.

Much of our growth has been realized through immigration.

There is no way we will fulfill 11M jobs without bringing in outside talent.

We just need to await action plans once it is time to fulfill these roles.

The decriminalization of marijuana that has been underway for several years, looks to be progressing. Perhaps, a portion of fulfillment will come from these plans.

Otherwise, we will see how our 11M open jobs will be filled.

As the fed raises rates, unemployment will rise. We can only expect that some of the demand will subside. How much? Only time will tell.

However, there will still be millions of job to fulfill.

Let’s review the next topic.

Infrastructure

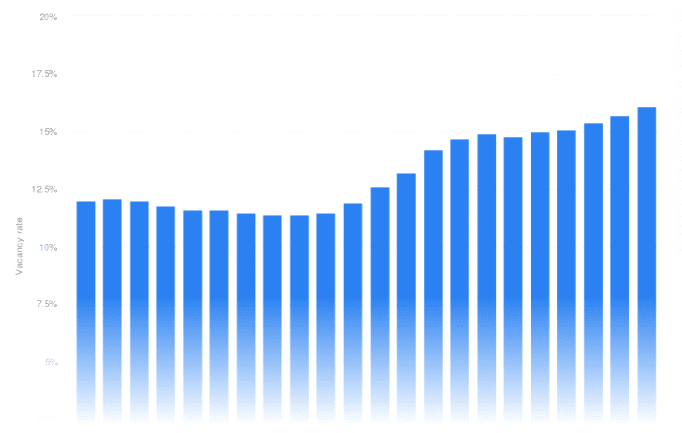

Ecommerce has well-known emergence within all industries.

As it still grows, commercial space for distribution, has been undersupplied. Vacancy rates are at all time lows for warehouse space.

On the contrary, office and some retail space has taken a turn post COVID-19. Vacancy rates are seeing all time highs in the office space sector.

Meanwhile, retail space is struggling from the overwhelming supply and labor challenges.

- So, what does this mean and how does it affect local economies?

Every source of tax dollars matters and local economies revolve their budgets around revenue. So, when revenue decreases, those deficits are attempted to be gathered from other or new sources.

When the times comes where long-term leases need to be renewed, we will see how vacancy is affected then. We know many tenants may not renew their leases due to remote working or simple downsizing.

- If (or when) tenants stop renewing, there will be less taxes collected in that local municipality.

This is when infrastructure will matter and a direct refection of the degree of who has been affected and why, will be shown.

It is a common known fact that some city’s infrastructures have not been sustainable over the long-term. Compounding old infrastructure issues with new ones, could bring about a viable infrastructure concern.

See the trend below of current vacancy rates for commercial real estate as a whole.

Office Vacancy Rates in the U.S. from Q2 2019 to Q1 2022 (courtesy of statista.com)

Commercial real estate and the revenue it produces can be transformed into new revenue streams. Conversions are a hot topic of discussion to help address the infrastructure concerns.

- The question will be, how many of these conversions will be viable based upon return on investment?

- Will the government need to institute another bailout?

We can see how the decriminalization of marijuana can also help bring revenue to each state to counter this issue.

Conclusion

Amongst supply issues, inflation, production, immigration and infrastructure, we see these are top concerns for the progression of our economy.

While some of these are being addressed in the public light, we hope that they are not being missed and there is a capable plan is in place to support recovery for all of them.

Thank you for joining us today faithful readers – future leaders.

Love ya and continue to strive for growth.

Please comment your thoughts on the topics today and what you would add to this list.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.