Step by Step Guide on How to Start an LLC

Starting a business?

Good for you! We wish you great success!

This is a great milestone! Keep up the good work and be sure to set your goals along a timeline.

We recommend you consult with your accountant and attorney on the ideal entity structure for your new business.

Whether you’ve planned to set up an LLC using a service like ours, or you’d like to learn to do it yourself, here is a free guide! Start a business from home or in general, you can use this guide.

- If you’d rather have it done for you, connect with us here.

- We file LLC formations and FinCEN BOI reporting separately.

So, let’s get to it!

Introduction

When we talk about setting up a business, you’ll require doing more than just setting up your workplace. You’ll need to look into a variety of things to be completed before you begin making income.

Nevertheless, among the many paths to business ownership, you’ll notice that there are several steps, which will we will make it more simple for you today.

If you want to start a business, establishing a Limited Liability Company (LLC) could be a wonderful option. LLCs are simple and cheap to set up.

What’s more helpful is, they are easy to operate. They have most of the benefits of bigger corporations without all the legal compliance, regulations, and rules seen with other business entities.

However, to understand the process in starting a limited liability company, you must understand the features first.

What is a Limited Liability Company?

A limited liability company features a combination of partnerships.

It has;

- The legal protection of personal assets of the owner.

- The creditors can’t pursue the LLC through bankruptcy as they can with corporations.

Similar to a corporation, an LLC is established at the state level, and it has limited liability.

That denotes that the assets and debts of the company belong only to the company, not the individual. Therefore, if or when your business is sued, the damages are limited to the assets of the LLC.

The encouraging tax structure of a limited liability company is another advantage which attracts small business owners. In fact, it’s categorized as a “pass-through entity,” meaning any losses or earnings are passed on to the owners.

The members will pay them by paying their own income tax rather than your business paying its’ taxes separately. Business losses and profits are reported on the personal income tax return of the members. Hence, you could prevent taxation.

Steps on Starting an LLC

To start an LLC, you will be required to file documents with your state where your business is located. Always remember that each state has its’ own process and rules.

However, you will find the steps below, you need to follow to get your business up and running, wherever you live in the U.S.A.

Step 1. Picking a Name for your LLC

The majority of states do not permit two different business entities to have the same (or very a similar) name. Therefore, you cannot have “Ian’s Noodles, Inc.” and “Ian’s Noodles, LLC” even if they are situated in a different location. Most states also restrict businesses from utilizing particular words in their business names.

- First, complete an LLC search on your states website to see if the business name is available. Try to create a few possible names, just in case your initial potential business name is taken. This will get you clarification on if you will be the only entity with that name in your state. Next you will want to do a nationwide search using google. If your business grows to where you are a national brand, you’d want to know if there are other businesses of “like-kind” with the same name in other states. A conflict of interest could arise if your two businesses with the same name in different states cause confusion for the customer. This could cause litigation where one company could feel your business has caused them a loss. Therefore, check google for the exact name of your business and check the industry of any company that has a similar name. If you don’t find a match, you are good to go. Doing this will clarify whether your preferred LLC name is accessible on the state and national level.

- Try to choose a name that is unique and memorable for the customer. Selecting a unique name could alleviate customer confusion as well as trademark infringement claims.

- Also make sure you check whether a domain name is accessible, matching your business name. This is important if you intend on setting up a website. This is especially important if your business will rely heavily on the internet. This is an important step. You wouldn’t want to confirm the business is available nationally and state wide and them find out you wont be able to set up a website even remotely close to your business name. There are claims on domains even though the business may not be in operation. People actually buy domains that may end up being popular to sell them later as an investment.

Step 2. Prepare to Apply for Your Federal Employer Identification Number (FEIN)

For applying for your FEIN (Federal Employer Identification Number) – go to www.irs.gov. You can only apply and submit for one new FEIN once per day.

- Go to File hover and select – Business and Self Employed

- Read & Choose tile for Employer ID Number (EIN)

- Read & Choose tile for Apply for an EIN Online

- Read & Choose Apply Online Now

- o Read prompt and select OK

- Read & Choose Begin Application

- Read & Choose Limited Liability Company (LLC) and click Continue

- Read and click Continue

- Enter how many members are in the LLC and select the state where the business is located. Click Continue

- Read and Click Continue

- Select Start a new business. Click Continue

- Enter your name, suffix if applicable, social security number, and click the “I am one of the owners, members of the managing member of this LLC.” Unless you are a third party setting up the LLC, then click appropriate selection. Then click continue.

- Input all fields for the address of the LLC in the appropriate fields. Enter the phone number for the LLC. Select yes or no if you want the mail for your LLC to go to a different address. Then click continue.

Step 3. Verify Your Physical Location

- Enter legal LLC name as filed/approved with the state you incorporated in. Enter the LLC address and start date. The start date will be the month in which the LLC will be formed.

- Call your state office to confirm how long it will take for filing if you are mailing in your application. If you are filing online, allow 2 weeks maximum. Usually, online applications are completed within one week.

- Click Continue

- Answer all the detail questions accordingly. Click Continue

- Select your industry (or select other and describe your nature of business). Click Continue

- Answer questions about your line of business. Click Continue

- Select to receive letter online (which will be immediate with your FEIN number) or select “Receive a letter by Mail.” Click Continue.

- If you select to receive letter online be sure to print and save a copy for your records. You need this to open your bank account.

- You will also need the FEIN number for your state filing completion to open the bank account.

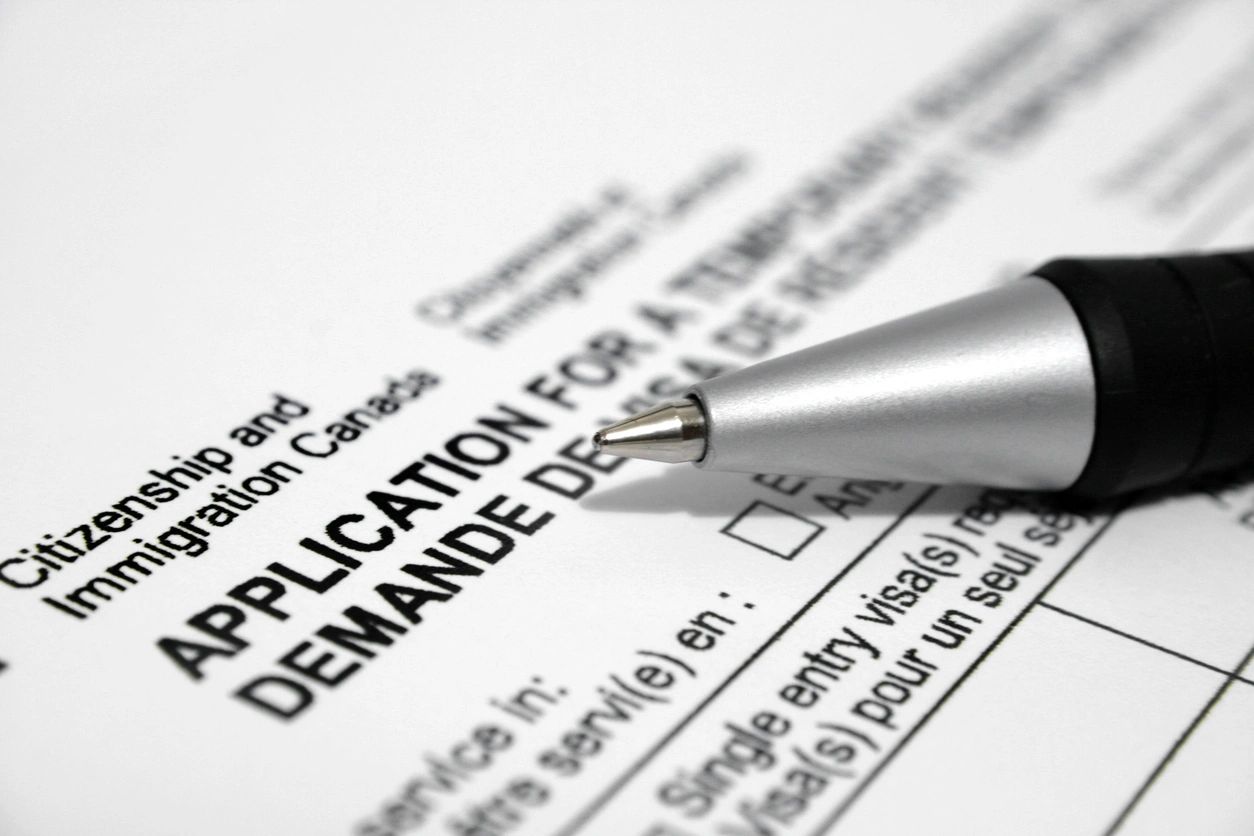

Step 4. Completing the State Application

Go to your states website to file Articles of Incorporation. When searching online, you will find that all state sites end in “.gov”.

- When you get to your states site, the easiest way to find where you’ll file online is to use the search option and enter “business online filings”.

- Enter this and click search on your screen or press enter on your keyboard.

- You will see the appropriate links populate that will send you exactly to where you need to go.

- Choose the link for Online Filing.

- At this point you will need to register for an online account. Select Sign Up Now to complete your registration.

- The direction we are giving is for filing online. You can choose to print the form and follow the same directions, but filing online will get your application completed the soonest.

- If you don’t want to file online, your search (in the search bar) will be entered as “Articles of Organization” after arriving to your states website.

- Click enter or click the search button on your screen. Business Registration Forms is likely the heading you will be looking for.

- Select it and let’s proceed.

- You should see two columns that will list the entity types and the corresponding form names.

- If you are filing an LLC in the state you live in, you will need to select the link under Domestic Limited Liability Company and choose Certificate of Organization. Print your form and proceed to the directions below under ONLINE APPLICATIONS START HERE.

- If you are filing to form an LLC in a state you don’t live in, you will need to complete a foreign limited liability company registration. Follow instruction on your state’s website for this set-up. (We will only be providing direction on setting up a domestic limited liability company.)

- Once completed, your registration will be filed with an agency in your state of organization. In the majority of states, the Secretary of State processes the LLC formation paperwork. Except in Nebraska and Iowa, all states provide either an online form or a paper form you can fill out.

ONLINE APPLICATONS START HERE:

- Choose Domestic Limited Liability Company

- Choose Certificate of Organization

· PAPER APPLICATONS START HERE (ONLINE CONTINUED):

- Select appropriate veteran status. Click Save and Continue

- Enter business name and “Limited Liability Company” or “LLC” – your choice. This is how your company will appear on record. Click Search to confirm the name is available. Save and Continue

- Choose your business address. Choose if this is your initial registered office or a commercial registered office provider.

- If you don’t want your personal home address listed on record and available to the public, do not use your home address. You may use another address, but it cannot be a PO BOX.

- Click Save and Continue

- Choose the Organizer. The organizer can be you or another company you own if that company is managing your LLC. The address is also needed here. Click Add Organizer. Click Save and Continue

- Choose when your company is effective. Choose if you want your effective date to be when your state completes the filing or choose a specific date in the future that you prefer.

- Choose if you are deemed a professional company by practice and if you will serve the public.

- If you will serve the public, be sure to check with your state on licensing requirements.

- Click Save and Continue

- Provide the individual name and mailing address for who is responsible for the taxes. You can use your name here if applicable and the business address or your home address here (if that is your choice).

- Input your FEIN (Federal Employer Identification Number) from the IRS.

- Include a description for your business. Click Save and Continue

- Sign and submit your request to incorporate.

Step 5. Follow-Ups

You will receive a follow-up form from the state when your filing is complete. If there are any issues, the state will identify these corrections and request the correction or clarification as needed.

Once received, print and save your corporate documents in a safe place for your records.

- You will need to use the state Certificate of Organization and the FEIN IRS documents to open a bank account.

That FEIN number is similar to a social security, number but is specifically for your business. Be advised, that each LLC that will pay taxes or hire employees, will require an EIN. Remember LLC’s have ‘pass through’ taxes. So your expenses and profits will go directly to your personal taxes. You also have the option of setting up an LLC to be taxed as a corporation. Feel free to connect with your accountant for more details if you decide to implement this option.

Next you will need to complete your SS-4 (IRS form). Applying from the website of IRS will only take a few minutes to complete. Consult with your accountant on this step.

Step 6. Complete!

You are complete with organizing your company. You are ready to do business!

Congratulations! We wish you well! Be sure to consult with your accountant and attorney on your new business.

Who Could Start an LLC?

Most individuals in good legal standing can build their own LLC.

You must always take into consideration, starting an LLC, if you prefer to control your personal exposure and liability.

Establishing this type of business entity provides better protection for your personal assets from any debts or claims the business has against it.

You must take note that not every business could be ran as an LLC. For instance, businesses that are managing insurance or banking are prohibited from operating as an LLC.

You will also find other restrictions from one state to another. For instance, California prohibits some professionals from forming an LLC.

Where to Form Your LLC?

Anonymity

If you are considering creating a business within your home state, it makes sense to start an LLC.

However, for anonymity, you might consider starting an LLC in Nevada, Delaware, Wyoming or New Mexico.

Any other business friendly states will not grant anonymity to your business.

Foreign Entity

Are you considering establishing your business in states other than where you live?

If yes, you are obliged to file as a FOREIGN LLC. For instance, you live in Delaware, and you do your business in North Carolina.

If that’s the case, you are obliged to file and pay fees to the government of North Carolina and file your North Carolina LLC as a foreign entity.

Are There Any Professionals Who Cannot Create an LLC?

You might find businesses which are engaged in insurance, law, medical practice and banking.

Often, they are banned from creating an LLC due to having a classification requirement to file as a professional.

In these cases, these companies may be required to file as a Professional Limited Liability Company or PLLC.

In addition, some states prohibit particular individuals like accountants, lawyers, doctors, and architects from coming together to set up an LLC.

You can check the laws of your state to determine if your business is qualified to create an LLC.

Is There A Minimum Amount of People Required to Create An LLC?

No. There is not a minimum number of individuals required to create an LLC. One member is sufficient.

A single member LLC is not the same as a sole proprietorship.

An LLC protects the person from the entity’s liabilities where a sole proprietorship does not.

Who Are LLCs Ideal For?

Dealing with your business as an LLC makes sense in two different scenarios.

- First; the business has risk, worthy of possible litigation, or it has the chance of accumulating huge quantities of debt.

- Second, the proprietors of the business have quantities of personal assets they wish to protect from any possible liability connected with the business LLC.

These are both ideal scenarios to establish an LLC.

Do You Need an Operating Agreement?

Even though the majority of states don’t oblige LLCs to be operated by an operating agreement, you will find different reasons why having an operating agreement would be a wonderful idea:

- It prevents the default rules, which would be imposed by the state absent an operating agreement.

- It could address conflicts among owners before they arise.

- It could help guarantee that the standing of your business as an LLC would be legal and more treasured by the court when seeing your limited personal liability.

- It will command how meetings are held and it could layout the voting privileges of every member.

- It will create rules about the sharing of profits and losses between the owners.

What are the Advantages of Starting Up an LLC?

Are you now considering starting your own LLC? If you are still in doubt, below are some of the advantages of forming one.

1. No Location Pre-requisite

Did you know that you could still create an LLC even if you do not reside in the U.S.A.?

This offers you the liberty to establish your business anywhere on the globe.

For those who are residing in other countries, it’s suggested that you register in Delaware.

That’s because the state has the lowest fees and taxes to keep your business. Furthermore, they have the most flexible laws for business.

2. Credibility

An LLC could offer you more protection than your competition.

Each of your potential collaborators, workers, and clients will appreciate your professionalism.

This shows you have a good commitment to your work and are registered as a business owner.

3. Cost-efficient and Easy

Cost and paperwork might discourage you from making your business legal.

Luckily, planning and maintaining an LLC is simpler than creating a company.

In case you didn’t know yet, establishing your LLC business is not as complex as setting up a corporation. The cost for the LLC application differs by state, but normally, it is small.

When you decided to set up an LLC business, expect that you are not obliged to appoint board officer positions.

You are not required to document your company values, mission and goals or perform yearly meetings. Maintaining your LLC is only as simple as meeting the requirement and taxation policies of your state and the IRS regulations.

Rigorous record-keeping is highly suggested to maintain your assets and business safeguarded.

Also, be sure to consider each states rules and fees for annual reports. Some states require an annual report be completed and some states have fees. Fees vary.

Take this in consideration when choosing where you incorporate your LLC.

- Check here for reference LLC Filing Fees By State.

4. Tax Advantages

Starting up an LLC offers you the choice to personalize your advantages to suit your requirements.

Once you create your LLC, you’ll have two taxation choices to choose from:

- Corporate Taxation – You are allowed to pay taxes as a business owner. You pay for personal taxes on any income you earned as the owner.

- Pass-Through Taxation – Your earnings will be taxed as you are in a partnership. That denotes that all your taxes are transferred from your LLC into your personal tax returns.

5. Safety of Your Assets

Setting up an LLC controls your responsibility for you as an individual.

That includes anything, which takes place throughout the lifespan and growth of your business.

Moreover, your personal assets are protected from a lawsuit.

Conclusion

Starting an LLC is an excellent thing.

However, you need to ensure that you pay attention to all the small details and tips you need to do online.

You’ll be able to leverage that data into a formidable company if you do not take shortcuts or skip steps.

In business, the best plan is to follow all the rules and ensure you are on the top of your game. Otherwise, you will incur penalties to deal with.

As advised, be sure to consult with your accountant and attorney on the ideal entity structure for your business.

We hope we presented you the necessary details you need in setting up your new LLC.

- If you’d rather have it done for you, connect with us here.

- We file LLC formations and FinCEN BOI reporting separately.

Nice job taking initiative! Keep it up faithful reader-future leaders!

Love ya and good luck with your future endeavors!

Please comment your first business set-up and the entity structure utilized…

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.