Personal Financial Planning Made Easy – Simple and Effective Budgeting Anyone Can Do

Are you tired of looking at your bank account at the end of the month only to find it’s as barren as the Sahara Desert?

Do you feel like you’re drowning in credit card debt and wonder if you’ll ever be able to save for retirement?

If you answered yes, you’re not alone. In fact, over 80% of all Americans say they struggle every month to make ends meet, while 77% report feeling stressed or anxious about their finances.

It’s no surprise that so many adults struggle with budgeting since personal financial planning is rarely taught in schools.

The good news is that even if you’ve never budgeted before or tried and failed, with the right system, you can finally find success.

What is Financial Planning & High Net Worth Financial Planning?

Personal financial planning is simply creating a budget from your earnings.

It involves looking at your total income and spending and allocating a set amount for different categories.

These include bills, credit cards, gas, groceries, savings, and more.

High net worth financial planning is similar, with the goal of accumulating wealth for yourself and your family.

Both types of planning go hand-in-hand and are essential for creating a secure financial future.

Knowing Your Budget and How You Can Put Your Money to Better Use

Let’s face it: budgeting is hard.

Our society glorifies spending and instant gratification.

The concept of savings often takes a backseat, but if you’re not thinking about your future, you’re setting yourself up for difficulties later on.

Fortunately, if you know how to do it, creating a budget is easy and actually fun (yes, we mean it!); it all starts with the 50-30-20 Rule.

What is the 50-30-20 Rule?

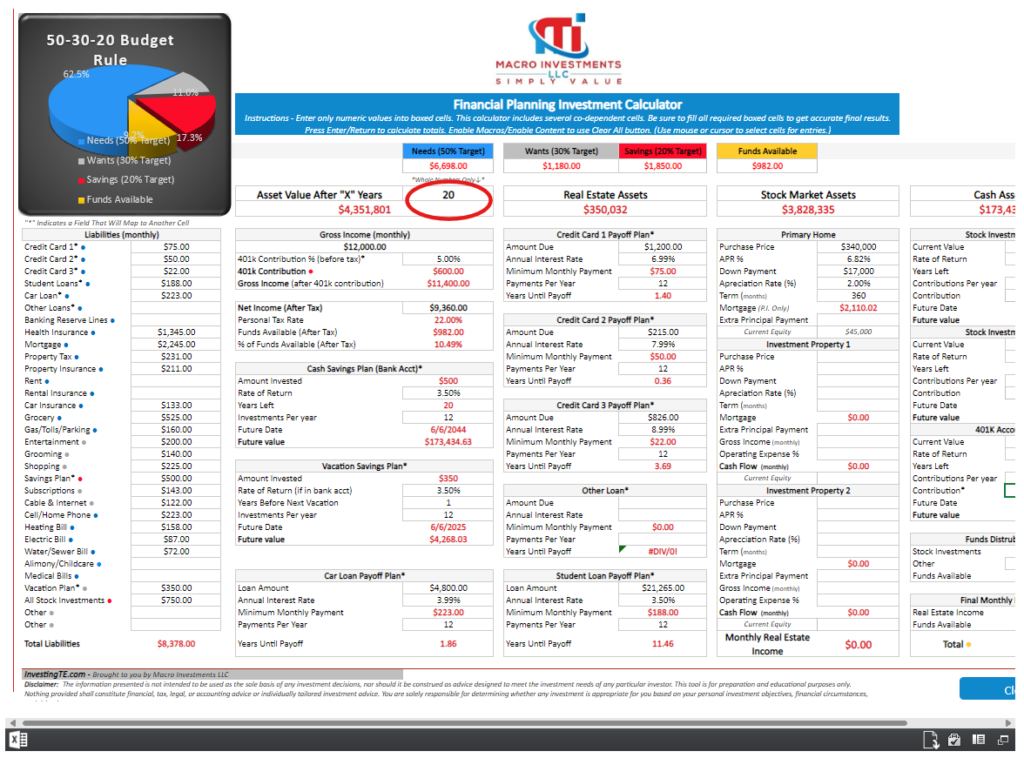

The 50-30-20 Rule is a budgeting strategy that allocates 50% of your earnings toward your needs, 30% toward your wants, and 20% toward your savings.

It’s an excellent option for beginners since you’re learning to prioritize needful spending while still having enough for your wants and future savings.

A financial calculator is essential with this system since it shows you how much you’re spending and makes it easy to see how you can use your money more effectively.

For instance, if you find a large portion of your income goes towards eating out, you can begin saving money immediately by cooking at home.

Having a visual of where your money goes is an invaluable tool that makes budgeting easier.

What is a Financial Calculator?

A financial calculator is a system that lets you input your earnings and expenditures to develop a budget.

While the concept may sound simple, they’re not all created equal.

Some are overly complicated, making them confusing and hard to use.

- InvestingTE.com saw the need to simplify budgeting, financial planning, and investing and created its free interactive Financial Planning Calculator.

Now, you can see the impact of your spending and savings habits and make changes that align with your overall financial goals.

But before we show you all of the exciting features this system offers, you need to start with the first step: evaluating your budget.

Create a Plan and Stick to It

Once you’ve taken the time to create your budget, it’s time to evaluate your current spending habits. Seeing your finances laid out in front of you allows you to assess your current spending plan and see where it will lead you if you keep it as-is.

This step is where InvestingTE.com’s free interactive Financial Planning Investment Calculator comes in.

- Since the calculator is a Microsoft Excel-based tool, you can easily input different amounts into each expenditure section. As you enter your dollar amounts, the calculator automatically updates, allowing you to see your budget in real time.

- It clearly lays out your needs, wants, savings, and available funds for budgeting at a glance. You can also see loan and credit card payments as well as payoff times and interest.

- Having all of this information in front of you lets you see where your current savings and investing plans will land you, which is essential when planning for the future. It also shows you when you’ll pay off your debts so you can begin putting more towards your wealth goals.

- If you have real estate or stock investments, including a primary home and a 401k, being able to see what you can expect from them is a key part of financial planning, and with the free interactive Financial Planning Investment Calculator, it’s easy. You can adjust your interest rates, payments, and deposit amounts for an up-to-date look into your investments.

Personal Financial Planning for the Future

While setting your current budget will get you on the right track, seeing what you can expect in the future will keep you motivated to stick with it.

That’s one of the best parts of InvestingTE.com’s Financial Planning Investment Calculator. It allows you to see financial projections for any number of years into the future, giving you a comprehensive view of how your current saving and spending habits will work for you.

Having one tool that provides interactive performance evaluations, updated planning capabilities, and future net worth projection will allow you to finally set a budget you can stick to.

Personal financial planning doesn’t have to be complicated.

The free interactive Financial Planning Investment Calculator from InvestingTE.com makes budgeting simple for everyone.

- This easy-to-use Microsoft Excel-based tool allows you to input your income and expenditures, enter your credit card and loan payments, and plan your future savings.

- With one click, it updates all of your information so you can see how your budget works for you.

Purchase our Financial Planning Investment Calculator to take control of your budget and discover true financial freedom today!

InvestingTE.com proudly offers tools, education, and services for real estate and stock market investing, business development, LLC formations, and FinCen filings. We create tailored services designed to empower your wealth journey and start you on the path to success.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.