How to Acknowledge Opportunities While the Fed Keeps Raising Interest Rates

How are you reacting to current events, employment, inflation and forward planning?

We know the fed will announce another rate hike tomorrow, but what will they raise it to?

There are many variables and targets to consider what could be possible.

The unemployment rate is a key metric to determine if all the fed’s adjustments are helping meet their targets.

We have made progress.

However, is the progress occurring at the rate the fed intends?

Today, we will discuss unemployment, how it relates to fed targets and opportunities for current employers.

Let’s get started.

Historical Trend

To start, there is not much difference in the trend of employment, comparing past normal trends, and the last nonfarm payroll and unemployment report.

If you review some of the reports prior to COVID-19, you will see that statistics are very similar to what business has looked like in normal economic conditions.

The fed is adamantly trying to create economic indicators to show that commerce is slowing down and getting us back to a healthy inflation rate of 2% to 3%.

Currently, outside of housing, these targets are not well indicated.

With that being said, it would be interesting if the fed does not increase its sentiment, in how much rates need to be raised tomorrow.

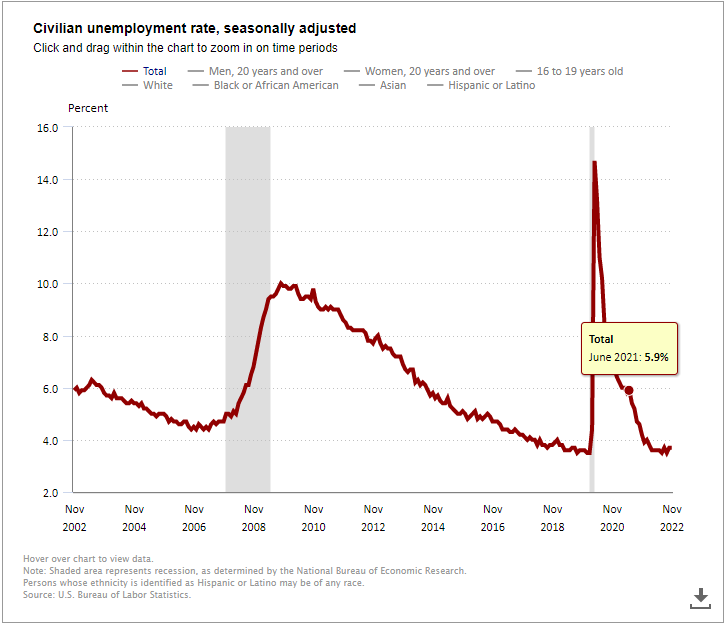

Several economists have indicated an unemployment target of 5.5% to 6% in order for the inflation rate to decline to heathy territory.

See the chart below of the unemployment rate in the last 20 years.

- Notice that the unemployment target is at the rate seen prior to reopening.

We peaked at 14.7% during COVID lockdowns in April of 2020.

However, the amount of increase in unemployment necessary to get us into a healthy state, is considerably large.

Perhaps, the plan is to see us reach these unemployment rates in the first quarter of 2023.

This is very likely, with the year-end reports weighing so heavily on what employers will need to adhere to.

November 2022 Employment Situation Summary

Here are some statistics to be aware of from the U.S. Bureau of Labor and Statistics.

As mentioned, the November reports in prior years, prior to COVID, were very similar to the most recent report.

Therefore, what the fed has done thus far is not as effective as the targets they’d like to see.

- It would not be surprising if the fed raised the fed rate by 75 basis points tomorrow.

- The CPI report will be very important. It could counter the current unemployment stats, reducing the likelihood of a raise above the estimated 50 basis points.

Total nonfarm employment increased by 263,000 in November.

The unemployment rate was unchanged at 3.7%.

The following sectors saw increases in employment.

- Leisure & Hospitality – 88,000 jobs.

- Healthcare – 45,000 jobs.

- Government – 42,000 jobs.

- Other Services Industries – 24,000 jobs.

- Social Services – 23,000 jobs.

- Construction – 20,000 jobs.

- Information – 19,000 jobs.

- Manufacturing – 14,000 jobs.

- Financial Activities – 14,000 jobs (of this 13,000 were in real estate and rental and leasing).

- Motor Vehicles and Parts Dealers – 10,000 jobs.

- Air Transportation – 4,000 jobs.

- Professional Business and Technical Services – 28,000 jobs.

The following sectors saw decreases in employment.

- Retail Trade – 30,000 jobs.

- Business Support Services – 11,000 jobs.

- Transportation and Warehousing – 15,000 jobs.

Acknowledging Opportunities

While acknowledging so much room for improvement, and necessary change shared in today’s article, it is also important for business owners to recognize opportunities.

Before we cover more regarding the current layoff situation, it is important to understand the difference between layoffs and downsizing.

- Layoffs can easily be a reduction in labor where it only affects close to entry-level employees.

- However, with downsizing, there is the acknowledgment that a company recognizes that it needs to introduce new operating plans. When this happens, leaders are usually first to see these reductions.

Leaders, say hello to more responsibility and maybe a little more pay…

After company adjustments are made at the leadership level, then a reduction in the labor staff could occur.

We can expect both to be occurring now and in the beginning of 2023.

- With that being said, expect opportunities to scout new talent if you are hiring.

There is likely to be a great pool of talented individuals re-entering the job market looking for new opportunities.

Conclusion

The objective when rates are raised is to reduce economic debt and increase liquidity.

During the course of this objective, individuals must tighten their budgets, reduce any waste, focus on growth and development, and locate opportunities that will support all of these goals.

When this happens, the economy gains strength, reduces debt and develops higher levels of talent. Compared to an economy where conditions are less demanding or with consistently low interest rates.

Expect to see forced growth and more change as we acknowledge more change in this era of change.

- See our article The Era of Change & Investing for more feedback on this topic.

Thanks for joining us today faithful readers – future leaders.

Love ya and continue to strive for growth.

Please comment your prediction for the fed’s rate increase today.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.