Unlock Your House Flipping Success – Master Your Finances with Our Exclusive Calculator!

Transform Your Fix and Flip Projects: Introducing Our House Flipping Calculator

Are you ready to take your fix and flip projects to the next level?

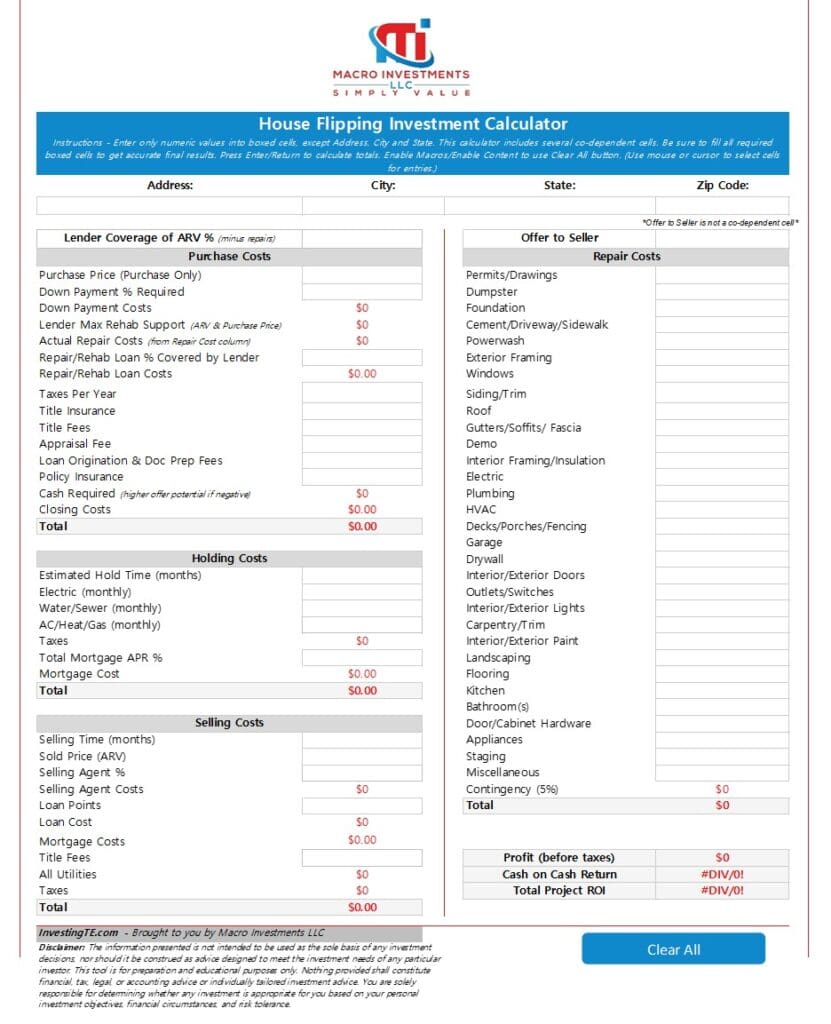

Say goodbye to guesswork and hello to precision with our House Flipping Calculator.

Learn how this powerful tool can help you evaluate deals, manage expenses, and maximize your profits with ease.

Crunching the Numbers: Why You Need a House Flipping Calculator

Don’t leave your success to chance – make informed decisions with our House Flipping Calculator.

Discover why this tool is essential for evaluating entrance costs, managing renovations, and predicting project profitability.

Say goodbye to ballpark estimates and hello to accurate financial planning!

Mastering the Basics: 5 Key Aspects of House Flipping Projects

Learn the ins and outs of successful house flipping with our comprehensive guide.

From understanding entrance costs to calculating project profitability, we’ll cover everything you need to know to succeed in the competitive world of real estate investing.

Evaluating Entrance Costs: Setting the Stage for Success

Discover the importance of entrance costs in house flipping projects and learn how to calculate them accurately.

Whether you’re purchasing with cash or financing, our House Flipping Calculator provides the insights you need to make smart financial decisions from the start.

- A cash purchase would eliminate payments towards a monthly note which helps profitability (if you don’t prolong the project due to not having a note).

- A private or hard money purchase would play a significant role in your overall profit margins depending on your leverage support for the purchase and the rehab loans.

- A traditional-institutional loan may be the lowest interest payment, but may cost you more for the down payment.

The entrance is a crucial aspect of any investments’ potential. Securing the ability to meet or exceed profit targets starts at the entrance.

Managing Renovations: From Planning to Execution

Get a step-by-step guide to managing renovations with our House Flipping Calculator.

From aligning contractor support to estimating line-item expenses, we’ll help you create a detailed operational plan that maximizes efficiency and minimizes costs.

Knowing, managing and executing your plan are crucial characteristics of having a successful project.

To estimate adequately, you need to assess where, why and how much, each line-item expense will cost you. Be sure to also account for contingency.

- Knowing what costs should be, is not only a means of understanding your operation. It is a protection mechanism to help you avoid being taken advantage of by an inefficient or untrustworthy contractor.

Predicting Project Profitability: Understanding Holding Costs and Selling Expenses

Learn how to predict project profitability with our House Flipping Calculator.

From estimating holding costs to calculating selling expenses, we’ll help you create a comprehensive financial plan that ensures your project meets or exceeds your expectations.

Discover how our House Flipping Calculator can help you make informed decisions and maximize your profits.

With its user-friendly interface and powerful features, this tool will become an invaluable asset in your house flipping toolkit.

Get started today and unlock your full potential as a real estate investor!

Your starting point is running your ARV.

Within running your ARV, you should know your average days on market prior to closing the sale.

- See our ARV Investment Calculator here.

- Or get the House Flipping Package 1 – including the House Flipping & ARV Investment Calculators for a 10% discount!

Considering the time to complete the renovation, and the time to sale the property, you have your total holding time.

As a part of the holding period, the time to sell is included.

However, there are costs associated to selling that you must account for as well.

Making Informed Decisions: Leveraging Our House Flipping Calculator

Discover how our House Flipping Calculator can help you make informed decisions and maximize your profits.

With its user-friendly interface and powerful features, this tool will become an invaluable asset in your house flipping toolkit.

Get started today and unlock your full potential as a real estate investor!

Invest in Your Success: Get Your House Flipping Calculator Today!

Don’t leave your success to chance – invest in the tools you need to succeed with our House Flipping Calculator.

Whether you’re a seasoned investor or just starting out, this tool will help you make informed decisions and maximize your profits.

Get yours today and start flipping houses like a pro!

House Flipping FAQ

What is the 70% rule in house flipping?

The 70% rule is in reference to your entrance strategy. The 70% rule formula, or 70% of ARV (after repair value), minus repairs, provides an entrance that supports your project being a success.

- It allows 10% for selling costs, up to 10% for holding costs, and 10% for profit.

- Holding costs normally amount closer to the 5% mark, leaving a total of approximately 15% for profit.

How much does the average house flipper make?

The average house flipper makes approximately 10% to 15% profit.

This amounts to about $10,000 to $15,000 for every $100,000 sales price.

Can you flip a house with $100k?

Yes. With the proper support, $100,000 is more than enough to renovate a property.

Out-of-pocket costs are usually the following:

- Down payment of approximately 10%.

- Closing costs of approximately 3-5%.

- Holding costs throughout the course of the project.

- Repair funds to support the draw process.

Get your house flipping calculator today to run your numbers.

How do you calculate profit from a flip?

If you are using the 70% formula, your profit is normally about 10-15% of the sales price, minus up front costs.

If your up-front costs for down payment and closing costs are about 4-7% of the sales price, you should consider this before entering a project.

- These up front costs, can easily reduce your profits to under 10% of the sales price.

Get your house flipping calculator today to run your numbers.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.