20 Real Estate Investment Strategies to Choose From

How did you go about selecting your first real estate investment strategy?

Many people select an investment strategy based upon familiarity.

But how about choosing based upon what supports your lifestyle and current obligations?

Today we will review how you can apply knowledge and technique that fits your lifestyle for on and off market properties.

Based upon the current events in your life there may be several applicable strategies you can conduct, but you’d never know unless you are aware of the options.

By reviewing some strategies today, maybe it will be helpful in you applying a strategy that is better suited for you.

Let’s start with one of the largest factors of when you can get started – barrier of entry.

Barrier of Entry

For most of us, barrier of entry is a huge component on if we can start an investment strategy or not.

We all know that reaching a prequalification status with lenders can take years of preparation.

However, it isn’t the only way to start investing. This is why this next part is such a crucial portion of understanding your capabilities and applicable strategies.

Comprehension of how the funding source relates to the investment strategy is crucial. – This is the basis to every investment strategy.

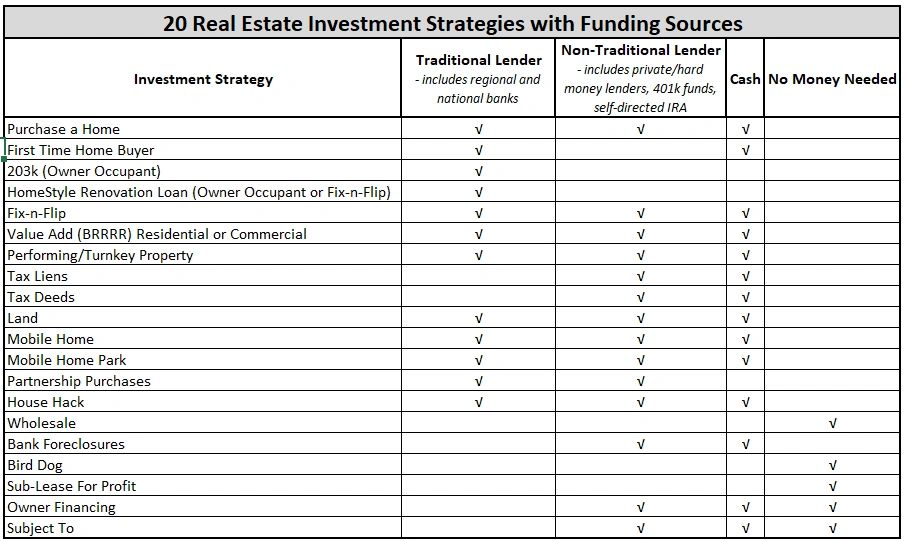

So, lets take a look at 20 investment strategies and each funding source that’s applicable.

Notice there are:

- 12 strategies where you can use traditional bank funding.

- 14 strategies where you can use non-traditional funding.

- 14 strategies where you can use cash.

- 5 strategies where no money is needed.

We will provide some sources for you to learn each applicable strategy later in the article.

But, before you dig into getting educated, review the chart below to review the approximate time required to sustain that strategy and how you can learn it.

Lifestyle and Capability

After reviewing all strategies that are capable, next you need to educate yourself on what is involved for each strategy.

By knowing what is involved, you can determine if the strategy would be sustainable for you based your current responsibilities.

Your current obligations including; time, access to money, mental and physical capabilities are the next factors to consider.

Will you hire someone to do this for you or are you going to do it yourself?

Be certain that hiring someone could be a hefty price tag. Also you need to have good knowledge on any subject to effectively screen anyone before you’d hire them anyway.

So, plan accordingly so you don’t waste time or money.

There is an effective balance in understanding what you can complete on our own, versus when we need to hire an expert.

- Time management is important and can only be gaged on a case by case basis.

- You need to know your own strengths and weaknesses to determine what is best for you.

Tools to Aid Your Education

Here are some great learning sources for each strategy mentioned today.

- Purchase a Home – Home Buying Kit For Dummies

- First Time Home Buyer – Securing Grant Money: Step by Step Guide For First Time Home Buyers or get our Home Buyer Investment Calculator which also includes an investment calculator for the full financial aspect of the home buying process.

- 203k (Owner Occupant) – How to Buy a Fixer Upper: Turn Your Old Home Into a Dream Home

- HomeStyle Renovation Loan (Owner Occupant or Fix-n-Flip) – See details here

- Fix-n-Flip – The Book on Flipping Houses: How to Buy, Rehab and Resell Residential Properties

- Value Add (BRRRR) Residential or Commercial – Buy, Rehab, Rent, Refinance, Repeat: The BRRRR Rental Property Investment Strategy Made Simple

- Performing/Turnkey Property – The Book on Rental Property Investing: How to Create Wealth with Intelligent Buy and Hold Real Estate Investing

- Tax Liens – Understanding Tax Lien & Tax Deed Investing: No Fluff

- Tax Deeds – Understanding Tax Lien & Tax Deed Investing: No Fluff

- Land – Dirt Rich: How One Ambitiously Lazy Geek Created Passive Income in Real Estate Without Renters, Renovations and Rehabs

- Mobile Home – The Invisible Deal: Why Mobile Homes Are The Perfect Investment and How to Flip, Wholesale and Rent Them

- Mobile Home Park – How to Invest in a Mobile Home Park: For Business, Money and Profit

- Partnership Purchases – Limited Liability Companies For Dummies

- House Hack – The House Hacking Strategy: How to Use Your Home to Achieve Financial Freedom

- Wholesale – The Real Estate Wholesaling Bible: The Fastest, Easiest Way to Get Started in Real Estate Investing

- Bank Foreclosures – Foreclosure Investing For Dummies

- Bird Dog – How to Become A Real Estate LOCATOR or BIRD-DOG

- Sub-Lease For Profit – Airbnb: How to Make a Six Figure Income Without Owning Any Property

- Owner Financing – Creative Seller Financing: How to Use Seller Financing to Buy or Sell Any Real Estate

- Subject To – Creative Cash: The Complete Guide to Master Lease Options and Seller Financing for Real Estate

We hope today’s article has been helpful for you. Thanks for joining us faithful readers – future leaders.

Love ya and keep striving for growth.

Please comment what strategy you started with and why.

FREE Deal Analysis for Rental Property Calculator!

Our mission is to help others develop using our knowledge and services.

We cater to those looking to grow professionally.

Explore our tools, education and services.